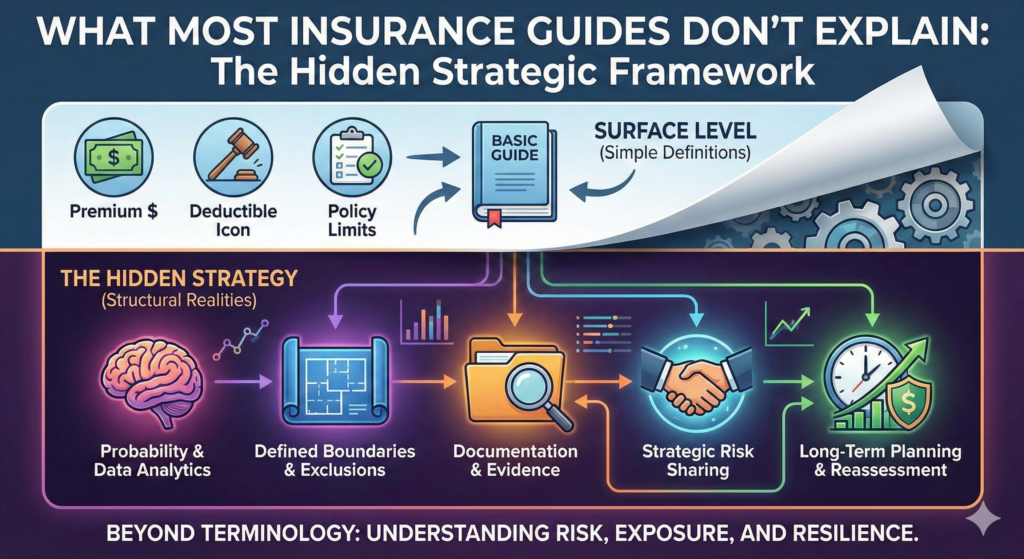

Most insurance guides focus on definitions. They explain what a premium is, what a deductible means, and how coverage limits work. While those basics are important, they often leave out the deeper context — the strategic thinking behind insurance decisions.

Insurance is not just about understanding terminology. It is about understanding risk, financial exposure, behavioral patterns, and long-term planning.

Many consumers purchase insurance without fully understanding how policies function in real-world scenarios. The result is confusion at claim time or disappointment when expectations do not match policy terms.

This article explores what most insurance guides do not explain — the structural realities behind how insurance actually works.

Insurance Is Designed Around Probability, Not Individual Fairness

One of the most misunderstood aspects of insurance is the pricing model.

Insurance is based on large risk pools. Premiums are calculated using statistical probability, not individual perceptions of fairness. This means:

- Two people with similar assets may pay different premiums

- Location can significantly influence pricing

- Industry classification can affect business insurance costs

Many guides explain pricing factors, but few clarify the principle behind them: insurance pricing is about predicting risk across groups, not tailoring fairness to each individual case.

Understanding this helps set realistic expectations.

Policies Are Written to Define Limits, Not to Cover Everything

Insurance contracts are highly specific. Coverage exists only where it is explicitly defined.

Most introductory guides explain coverage categories but do not emphasize this critical point:

If a risk is not clearly included in the policy, it is typically not covered.

This is why exclusions matter so much.

For example:

- Flood damage may not be covered under standard homeowners insurance

- Business use may be excluded from personal auto policies

- Certain professional errors may require separate liability coverage

Insurance policies are designed to define boundaries. They are not open-ended guarantees.

“Full Coverage” Is a Marketing Phrase, Not a Legal Term

Many consumers use the term “full coverage,” particularly in auto insurance. However, this phrase has no formal legal definition.

Typically, “full coverage” refers to a combination of liability, collision, and comprehensive coverage. But even then:

- Coverage limits still apply

- Exclusions still exist

- Deductibles still reduce payouts

Insurance guides often mention this casually, but the deeper truth is that no policy covers every possible scenario.

Precision matters more than informal labels.

Claims Are Evaluated Based on Documentation

Insurance companies rely heavily on documentation during the claims process.

Most guides describe the steps of filing a claim, but they do not emphasize how important record-keeping is.

Examples include:

- Home inventory lists

- Photos of property

- Receipts for high-value items

- Maintenance records

- Medical documentation

Without proper documentation, claim resolution may be delayed or limited.

Insurance works best when policyholders proactively maintain accurate records.

Deductibles Are Strategic, Not Just Financial

Deductibles are often presented as a simple cost decision: higher deductible equals lower premium.

However, deductibles are strategic tools.

They determine:

- How frequently claims are filed

- How risk is shared between insurer and policyholder

- The overall cost structure of the policy

Choosing a deductible should involve evaluating emergency savings and risk tolerance — not just monthly premium savings.

This strategic perspective is often overlooked.

Not All Risks Are Insurable

Insurance is designed to cover accidental and measurable risks. It does not cover:

- Gradual wear and tear

- Predictable maintenance issues

- Intentional acts

- Highly speculative losses

Some risks are either uninsurable or require specialty policies.

Many insurance guides focus on available products but do not clarify that insurance operates within strict insurability criteria.

Coverage Limits Matter More Than People Think

Coverage limits define the maximum payout for a claim.

While guides explain limits in numerical terms, they rarely emphasize how quickly costs can escalate.

For example:

- Legal defense costs alone can be substantial

- Medical expenses can exceed minimum liability limits

- Reconstruction costs may exceed outdated property valuations

Selecting appropriate limits requires realistic risk assessment, not arbitrary decision-making.

Insurance Is a Financial Stability Tool — Not an Investment Strategy

Certain types of insurance, particularly permanent life insurance, include savings or cash value components.

However, insurance should not be viewed primarily as an investment vehicle.

Its core function is risk transfer and financial protection.

Blurring the line between insurance and investment can create unrealistic expectations.

Understanding the primary purpose of insurance helps maintain clarity in financial planning.

Technology Is Changing Underwriting and Pricing

Modern insurance relies increasingly on data analytics.

Telematics devices in auto insurance, digital health records, cybersecurity assessments, and predictive modeling all influence underwriting.

While most guides mention technology briefly, they rarely explain its long-term impact:

- More personalized pricing

- Faster claims processing

- Increased data transparency

- Greater risk segmentation

As technology evolves, insurance becomes more dynamic and data-driven.

Insurance Requires Periodic Reassessment

Insurance is not a “set it and forget it” decision.

Life changes — such as marriage, home purchases, business expansion, or income growth — alter risk exposure.

Most guides suggest annual review, but they often underestimate how critical this practice is.

Outdated coverage is one of the most common causes of financial gaps.

The Emotional Side of Insurance Decisions

Insurance decisions are influenced by emotion as much as logic.

Some people overinsure due to fear. Others underinsure due to optimism bias.

Effective insurance planning requires balancing emotional responses with structured risk analysis.

This psychological dimension is rarely discussed in standard guides.

Insurance Companies and Risk Selection

Insurance companies do not accept every applicant without evaluation.

Underwriting assesses:

- Claims history

- Risk characteristics

- Industry exposure

- Financial stability

Insurance availability and pricing depend on risk assessment. Understanding this helps consumers appreciate why applications may require detailed information.

Why Insurance Can Feel Complicated

Insurance language can appear complex because policies must define legal boundaries clearly.

Precision protects both the insurer and the insured.

While guides simplify terminology, they may not explain that complexity exists to prevent ambiguity during disputes.

Insurance contracts prioritize clarity over simplicity.

The Real Value of Insurance

The value of insurance is most visible during unexpected events.

Its purpose is not to eliminate risk, but to prevent catastrophic financial disruption.

Insurance supports:

- Asset protection

- Income continuity

- Liability management

- Business stability

When structured properly, insurance creates predictability in uncertain environments.

Conclusion

Most insurance guides focus on definitions and product descriptions. What they often do not explain is the strategic framework behind insurance decisions.

Insurance is based on probability, defined boundaries, documentation, and risk sharing. It requires regular reassessment and realistic expectations.

Understanding these deeper principles allows individuals and businesses to approach insurance not as a transaction, but as a long-term financial protection strategy.

When viewed through this broader lens, insurance becomes less about paperwork and more about structured resilience.