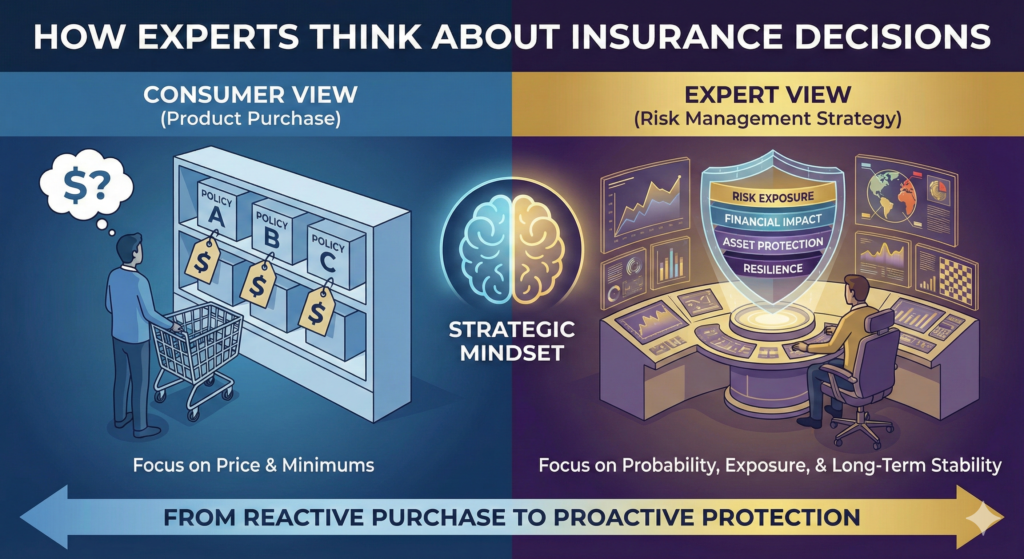

Most people approach insurance as a product purchase. Experts approach it as a risk management strategy.

This difference in mindset changes everything.

While consumers often focus on price comparisons and minimum coverage requirements, professionals in finance, business, and risk management think in terms of probability, exposure, asset protection, and long-term financial resilience.

Understanding how experts evaluate insurance decisions can help individuals and businesses make more structured and informed choices.

Experts Start With Risk Exposure, Not Products

Instead of asking, “Which policy should I buy?” experts ask, “What risks am I exposed to?”

They categorize exposure into areas such as:

- Property risk

- Liability risk

- Income risk

- Operational risk

- Regulatory risk

Only after mapping these exposures do they evaluate insurance solutions.

This approach prevents buying unnecessary coverage while reducing the risk of leaving critical gaps.

Insurance becomes a solution to a defined problem — not a generic purchase.

They Think in Terms of Financial Impact

Experts evaluate the potential financial severity of a loss.

For example:

- What would happen if my home were completely destroyed?

- What if I faced a major liability lawsuit?

- What if my business operations were interrupted for months?

- What if I became temporarily unable to work?

Instead of focusing on likelihood alone, they consider financial consequences.

Low-probability events with catastrophic financial impact often justify strong coverage.

They Understand Risk Transfer vs. Risk Retention

One of the most important distinctions experts make is between risk transfer and risk retention.

- Risk transfer means shifting financial exposure to an insurer.

- Risk retention means accepting a certain level of loss internally.

Deductibles are a form of risk retention.

Experts evaluate how much risk they can comfortably absorb without destabilizing their finances.

For minor, affordable losses, retaining risk may be reasonable. For catastrophic losses, transferring risk is typically preferred.

This balance defines a structured insurance strategy.

They Avoid Emotional Decision-Making

Insurance decisions are often influenced by emotion:

- Fear of unlikely disasters

- Overconfidence in personal safety

- Reaction to recent events

Experts aim to reduce emotional bias.

They rely on:

- Data

- Historical patterns

- Financial modeling

- Structured risk analysis

This reduces the likelihood of overinsuring due to anxiety or underinsuring due to optimism bias.

They Pay Close Attention to Liability Exposure

Liability is one of the most underestimated risks in personal and business insurance.

Experts understand that:

- Legal defense costs can escalate quickly

- Settlements may exceed minimum policy limits

- Liability exposure can extend beyond obvious scenarios

As a result, they carefully evaluate liability limits and consider umbrella coverage when appropriate.

Liability protection is often prioritized over minor property risks.

They Review Policy Language Carefully

Experts do not rely solely on summaries or marketing descriptions.

They examine:

- Exclusions

- Coverage triggers

- Definitions

- Sub-limits

- Endorsements

Insurance contracts are legal documents. Precision matters.

Understanding how coverage is triggered and where it is limited prevents surprises during claims.

They Align Insurance With Broader Financial Planning

Insurance decisions are integrated into a broader financial framework.

Experts consider:

- Emergency savings

- Asset allocation

- Debt levels

- Business structure

- Estate planning

Insurance is one component of financial resilience — not a standalone decision.

For example:

- Higher deductibles may be appropriate when strong emergency funds exist.

- Life insurance may align with income replacement needs and long-term obligations.

Insurance supports financial strategy; it does not replace it.

They Reassess Coverage Regularly

Risk exposure changes over time.

Experts review insurance when:

- Income increases

- Assets grow

- Business operations expand

- Laws or regulations change

- Family circumstances shift

They treat insurance as a dynamic component of financial planning.

Periodic review ensures coverage evolves with changing exposure.

They Understand Underwriting Factors

Insurance pricing is not arbitrary.

Experts understand that underwriting considers:

- Claims history

- Location

- Industry risk

- Credit-based insurance scores (where permitted)

- Operational practices

This knowledge helps them anticipate pricing structures and identify areas for improvement.

For example, improving cybersecurity practices may influence cyber insurance underwriting.

They Recognize the Limits of Insurance

Experts understand that insurance cannot eliminate all risk.

It does not cover:

- Normal wear and tear

- Predictable maintenance issues

- Intentional acts

- Certain regulatory fines

They avoid unrealistic expectations and focus on insurable, measurable risks.

This realistic perspective strengthens long-term planning.

They Evaluate Insurer Stability

Insurance is a promise of future payment.

Experts assess:

- Financial strength ratings

- Claims handling reputation

- Industry stability

Price matters, but reliability matters more.

Choosing a stable insurer reduces uncertainty during large claims.

They Consider Opportunity Cost

Every dollar spent on insurance premiums has an opportunity cost.

Experts weigh:

- The probability of loss

- The severity of potential loss

- The cost of transferring risk

This ensures premiums are proportional to exposure.

Insurance decisions are evaluated alongside other financial priorities.

They Think in Scenarios, Not Just Policies

Rather than reviewing policies in isolation, experts simulate scenarios:

- Major auto accident

- Property fire

- Professional liability claim

- Business interruption

- Cyber breach

They analyze how policies would respond collectively.

This scenario-based thinking reveals gaps that individual policy reviews may miss.

They Value Clarity Over Complexity

Insurance can be complex, but experts seek clarity.

They prefer:

- Clear coverage definitions

- Transparent deductibles

- Predictable claims processes

Complex policies are not necessarily better.

Clarity supports effective decision-making.

They Know When to Seek Professional Guidance

Even experts consult specialists in complex cases.

Insurance brokers, risk managers, and legal advisors may provide insights when:

- Exposure involves multiple jurisdictions

- Contractual insurance requirements apply

- Business structures are layered

- Specialty risks are present

Seeking advice is not a weakness — it is part of structured risk management.

The Strategic Mindset

Ultimately, experts view insurance as a tool for stability.

They ask:

- What risks could materially disrupt my financial position?

- Which of those risks are insurable?

- What level of loss can I absorb?

- Where does risk transfer make sense?

This strategic mindset transforms insurance from a reactive purchase into proactive protection.

Conclusion

How experts think about insurance decisions differs significantly from how most consumers approach them.

Experts begin with risk exposure, evaluate financial impact, balance risk transfer and retention, and integrate insurance into broader financial planning. They rely on structured analysis rather than emotion, review policies carefully, and reassess coverage as circumstances evolve.

Insurance is not about buying the cheapest policy. It is about building resilience against financial disruption.

Adopting an expert mindset does not require advanced credentials — it requires asking better questions and evaluating insurance through a strategic lens.