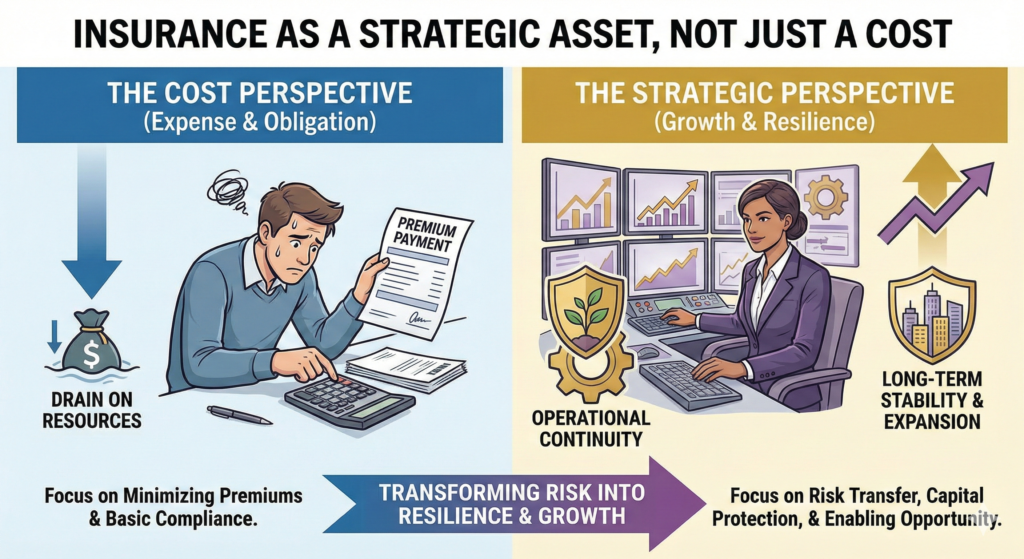

For many individuals and business owners, insurance is viewed primarily as an expense — a recurring payment that feels obligatory rather than beneficial. Premiums are often evaluated in the same way as utility bills or subscription services: something to minimize whenever possible.

However, experts in finance, entrepreneurship, and risk management tend to see insurance differently. They view it not as a cost center, but as a strategic asset — a structured financial tool that protects long-term stability, supports growth, and enables confident decision-making.

Understanding insurance as a strategic asset transforms how coverage decisions are made.

The Cost Perspective vs. The Strategic Perspective

When insurance is viewed only as a cost, decisions tend to focus on:

- Reducing premiums

- Selecting minimum required coverage

- Increasing deductibles to lower payments

- Cancelling policies during stable periods

While cost control is important, this narrow perspective can overlook the broader financial role insurance plays.

A strategic perspective asks different questions:

- What risks could materially disrupt my finances?

- What would be the impact of a major liability claim?

- How would my business operate after a serious loss?

- Could I sustain a prolonged interruption of income?

This shift in thinking reframes insurance from an expense to a protective financial structure.

Insurance as Risk Capital Protection

Every individual and business operates with risk capital — assets, income streams, property, and operational resources.

Insurance functions as a protective layer over that capital.

For example:

- Homeowners insurance protects equity invested in property.

- Liability insurance protects against legal claims that could exceed personal savings.

- Business insurance safeguards operational continuity and contractual relationships.

Without structured protection, a single severe event could significantly impact accumulated assets.

From a strategic viewpoint, insurance preserves long-term capital stability.

Enabling Business Growth Through Risk Transfer

Entrepreneurs often underestimate how insurance enables growth.

Businesses frequently require proof of coverage to:

- Sign contracts

- Lease commercial property

- Work with enterprise clients

- Participate in government projects

In this sense, insurance is not merely protection — it is access.

General liability, professional liability, and cyber insurance policies often serve as prerequisites for expansion.

When structured correctly, insurance supports scalability by reducing financial uncertainty.

Protecting Cash Flow Stability

Cash flow is central to financial resilience.

Unexpected losses can disrupt income through:

- Property damage

- Lawsuits

- Operational shutdowns

- Disability

Insurance mitigates these disruptions by transferring certain financial risks to insurers.

For example:

- Business interruption insurance can offset revenue losses during covered events.

- Disability insurance can provide income continuity during temporary incapacity.

From a strategic standpoint, insurance protects liquidity — one of the most critical elements of financial health.

Liability Protection as Asset Defense

Liability exposure is one of the most significant risks individuals and businesses face.

Legal claims can arise from:

- Accidents

- Professional errors

- Product issues

- Contractual disputes

Defense costs alone can be substantial, even if a claim is ultimately resolved without judgment.

Strategically structured liability coverage functions as asset defense, shielding savings, property, and business equity from unexpected legal exposure.

Viewing liability insurance as optional often underestimates its protective function.

Insurance and Financial Predictability

One of the most overlooked benefits of insurance is predictability.

Without insurance, losses are uncertain and potentially severe.

With insurance, financial exposure becomes more structured:

- Premiums are known in advance.

- Deductibles define retained risk.

- Coverage limits establish defined boundaries.

Predictability supports better financial planning.

For individuals, this means fewer unexpected disruptions.

For businesses, it enables budgeting, investment planning, and operational confidence.

Strategic Use of Deductibles

Experts treat deductibles as strategic tools rather than simple cost adjustments.

A higher deductible:

- Lowers premium expenses

- Increases retained risk

A lower deductible:

- Raises premium costs

- Reduces short-term financial exposure

Choosing deductible levels requires evaluating emergency reserves and risk tolerance.

When aligned with financial capacity, deductibles enhance efficiency rather than simply reducing cost.

Insurance as a Reputation Safeguard

For businesses, reputation is a strategic asset.

Proper insurance coverage:

- Demonstrates professionalism

- Signals reliability to clients

- Reinforces contractual credibility

Clients and partners often expect businesses to carry adequate coverage.

Insurance, in this context, supports trust and operational legitimacy.

Technology and Strategic Insurance Planning

Modern technology has transformed insurance into a more data-driven system.

Analytics, telematics, cybersecurity assessments, and digital underwriting tools allow for more precise risk evaluation.

For businesses in technology sectors, cyber insurance is increasingly considered a strategic necessity rather than an optional add-on.

Data breaches and digital disruptions can affect both finances and brand credibility.

Strategic insurance planning now includes digital risk considerations alongside traditional exposures.

Integrating Insurance Into Financial Strategy

Insurance decisions should align with broader financial goals.

For example:

- Growing families may prioritize income replacement through life insurance.

- Expanding companies may increase liability limits.

- Property investors may reassess coverage based on asset growth.

Insurance works best when integrated with:

- Asset management

- Cash flow planning

- Risk diversification

- Long-term financial objectives

When treated as a disconnected expense, its strategic value is diminished.

Avoiding the “Short-Term Savings” Trap

Reducing coverage to lower premiums may produce short-term savings.

However, strategic evaluation considers long-term consequences.

An underinsured property or inadequate liability limit may create financial strain during a major event.

Experts weigh premium savings against potential financial exposure.

Insurance should be optimized — not minimized.

Insurance and Entrepreneurial Mindset

Entrepreneurs often accept calculated risks to drive growth.

However, calculated risk differs from unmanaged risk.

Insurance allows entrepreneurs to:

- Innovate

- Enter new markets

- Sign larger contracts

- Scale operations

Risk transfer enables controlled expansion.

Without structured coverage, growth initiatives may carry disproportionate financial vulnerability.

Psychological Stability and Decision Confidence

Beyond financial metrics, insurance contributes to psychological stability.

Knowing that key risks are covered can:

- Reduce stress

- Improve focus

- Support long-term planning

Confidence in financial protection enhances decision-making.

This intangible benefit is rarely discussed but strategically relevant.

Insurance as Infrastructure

Infrastructure supports stability.

In the same way that physical infrastructure supports business operations, insurance supports financial resilience.

It forms part of the foundational structure that protects against disruption.

Viewing insurance as infrastructure reinforces its strategic importance.

Conclusion

Insurance should not be viewed solely as a recurring expense. When structured intentionally, it becomes a strategic asset — one that protects capital, supports growth, enhances predictability, and shields against liability exposure.

Individuals and businesses that adopt this perspective evaluate coverage based on long-term stability rather than short-term premium reduction.

Insurance, when aligned with financial goals and risk exposure, functions as a stabilizing force within an uncertain environment.

Strategic thinking transforms insurance from a cost to a cornerstone of financial resilience.