Insurance plays a critical role in modern society, yet it remains one of the most misunderstood financial tools. Most people interact with insurance only when they are required to — buying car insurance to drive legally, health insurance for medical access, or business insurance to comply with regulations. However, insurance is far more than a legal formality. It is a foundational system that enables economic stability, personal security, and long-term planning.

After years working closely with insurance structures and technology-driven business models, it becomes clear that understanding how insurance works is not optional. It is essential.

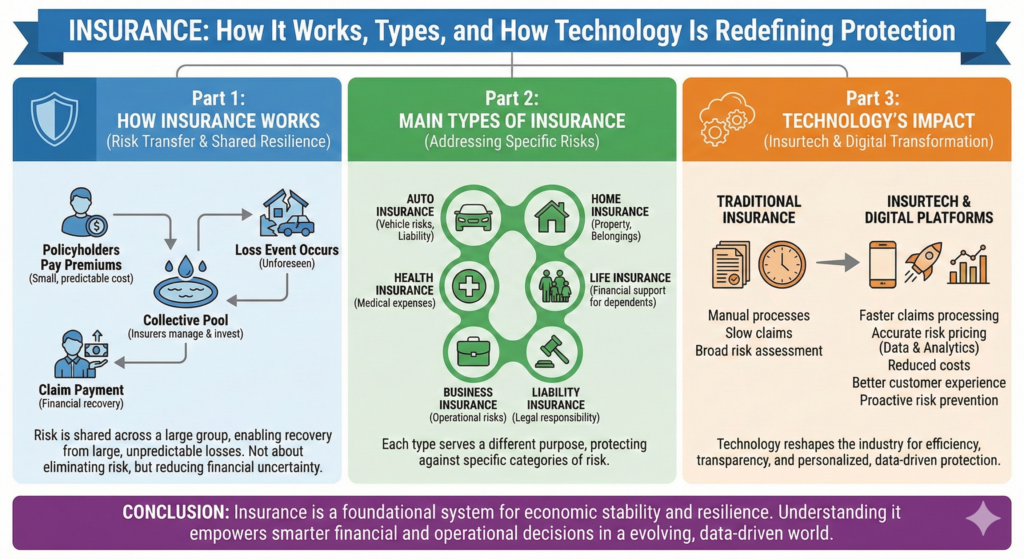

This guide provides a clear, practical explanation of insurance, the main types available, and how technology is reshaping the industry in ways that affect individuals and businesses alike.

What Insurance Really Is

At its core, insurance is a risk transfer mechanism. Individuals or organizations pay a relatively small, predictable cost (the premium) to protect themselves from potentially large, unpredictable losses. These losses might come from accidents, illnesses, lawsuits, natural disasters, or other unforeseen events.

Insurance works because risk is shared across a large group of policyholders. While not everyone will experience a loss at the same time, the collective contributions allow insurers to pay claims when they occur. This system relies heavily on statistical modeling, historical data, and probability analysis.

Importantly, insurance is not designed to eliminate risk. Instead, it reduces financial uncertainty and provides a structured way to recover from adverse events.

How Insurance Works in Practice

An insurance policy is a legal contract between the policyholder and the insurer. It defines what is covered, what is excluded, how much the insurer will pay, and under what conditions claims are valid.

Most insurance policies include:

- Coverage definitions that explain what events are protected

- Exclusions that outline what is not covered

- Policy limits that cap the insurer’s financial responsibility

- Deductibles that determine how much the policyholder pays before coverage applies

- Conditions that describe responsibilities on both sides

Understanding these elements is crucial. Many disputes between insurers and customers arise not from bad intent, but from misunderstandings about policy terms.

Why Insurance Matters More Than Ever

In countries like the United States, insurance is deeply embedded in everyday life. Legal systems, healthcare access, business operations, and personal finance all assume some level of insurance coverage.

Without adequate insurance, a single event — such as a medical emergency or legal claim — can create long-term financial hardship. From an expert perspective, insurance is less about probability and more about impact. Low-probability events with high financial consequences deserve the most attention.

Overview of the Main Types of Insurance

Insurance exists in many forms, each addressing a specific category of risk. While policies vary by provider and jurisdiction, most insurance products fall into several broad categories:

- Auto insurance, which covers vehicle-related risks and legal liability

- Home insurance, which protects property and personal belongings

- Health insurance, which helps manage medical expenses

- Life insurance, which provides financial support to dependents

- Business insurance, which protects companies from operational and legal risks

- Liability insurance, which addresses legal responsibility for harm to others

Each type serves a different purpose, and understanding these differences helps individuals make informed decisions rather than relying solely on minimum legal requirements.

The Role of Data and Risk Assessment

Insurance companies rely on data to assess risk accurately. Factors such as location, behavior, historical claims, and economic trends influence pricing and coverage decisions.

Traditionally, this process was slow and manual. Today, advanced analytics allow insurers to model risk with far greater precision. While this improves efficiency, it also raises important questions about transparency, fairness, and data usage — areas where regulation continues to evolve.

How Technology Is Transforming Insurance

Technology is fundamentally changing how insurance is designed, sold, and managed. Digital platforms now allow customers to compare policies, purchase coverage, and file claims online with minimal friction.

From a systems perspective, technology improves insurance in several ways:

- Faster claims processing

- More accurate risk pricing

- Reduced administrative costs

- Better customer experience

This shift has given rise to insurtech companies — firms that combine insurance expertise with modern software, automation, and data science.

The Rise of Insurtech

Insurtech focuses on efficiency and transparency. Instead of complex paperwork and slow processes, many digital insurers emphasize clear language, streamlined onboarding, and real-time support.

For consumers, this means easier access to information and faster service. For insurers, it means improved operational control and better risk management. While traditional insurers still dominate the market, technology-driven models continue to grow.

Insurance, Trust, and Regulation

Despite technological progress, insurance remains a highly regulated industry. Regulation exists to protect consumers, ensure solvency, and maintain trust in the system.

From experience, innovation in insurance must balance speed with responsibility. Trust is not optional in insurance — without it, the entire system fails. This is why transparency and compliance are just as important as technological advancement.

Why Understanding Insurance Is a Long-Term Advantage

People who understand insurance make better financial and operational decisions. They avoid common mistakes, select appropriate coverage, and view insurance as a strategic tool rather than an unavoidable expense.

For businesses and individuals alike, insurance enables risk-taking. It provides the confidence to invest, grow, and innovate without exposing everything to a single point of failure.

The Future of Insurance

The future of insurance is data-driven, personalized, and increasingly proactive. Instead of reacting to losses, insurers are beginning to predict and prevent them.

As technology continues to reshape the industry, those who understand both insurance fundamentals and digital transformation will be best positioned to navigate what comes next.

Conclusion

Insurance is not just about protection — it is about resilience. Understanding how insurance works, the types available, and how technology is changing the industry empowers individuals and businesses to make smarter decisions.

As insurance continues to evolve, informed users will benefit the most.