Most explanations of insurance stop at simple definitions: you pay a premium, and the insurance company pays if something goes wrong. While this description is technically correct, it barely scratches the surface. To truly understand insurance — and to use it effectively — it is necessary to look beyond the basics and explore how the system actually functions.

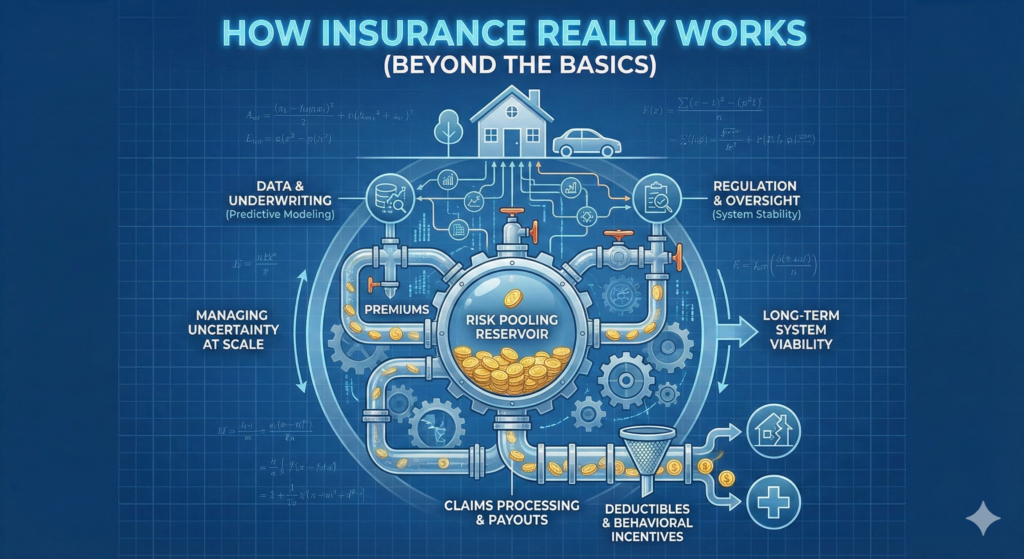

Insurance is not just a product. It is a complex financial, legal, and statistical system designed to manage uncertainty at scale. Understanding how it works behind the scenes helps individuals and businesses make better decisions and avoid common mistakes.

Insurance as a System, Not a Product

Insurance works as a system because it relies on the behavior of large groups rather than individual outcomes. While a single person cannot predict whether they will experience a loss, insurers can predict how often losses will occur across thousands or millions of policyholders.

This predictability is what makes insurance possible. By analyzing historical data and trends, insurers estimate how much money will be needed to pay future claims and price policies accordingly.

From an expert perspective, insurance is less about individual fairness and more about system-wide balance.

The Principle of Risk Pooling

At the heart of insurance lies risk pooling. Many people contribute small amounts of money into a shared pool. When a covered event occurs, funds from that pool are used to pay claims.

This approach spreads financial risk across a wide population. Without pooling, individuals would need to self-fund worst-case scenarios, which is impractical for most people.

Risk pooling works best when:

- The pool is large and diverse

- Losses are random and unpredictable

- Data is accurate and regularly updated

When these conditions are met, insurance remains sustainable.

Probability vs. Impact: A Critical Distinction

One of the most misunderstood aspects of insurance is the difference between probability and impact.

Some events are unlikely but financially devastating, such as major lawsuits or severe medical emergencies. Others are more common but less costly. Insurance focuses heavily on managing high-impact risks, even when their probability is low.

This is why insurance decisions should not be based solely on how likely an event is to occur, but on how severe the consequences would be if it did.

How Underwriting Really Works

Underwriting is the process insurers use to evaluate risk and determine pricing. It involves analyzing factors such as age, location, behavior, industry, and historical claims data.

Modern underwriting relies heavily on data and algorithms. However, it is still guided by regulatory frameworks and risk tolerance models. Insurers must balance competitive pricing with long-term financial stability.

From a systems standpoint, underwriting is where actuarial science, economics, and regulation intersect.

Why Premiums Are Structured the Way They Are

Premiums are designed to cover several components:

- Expected claims payouts

- Administrative and operational costs

- Regulatory requirements

- Risk margins for unexpected losses

Premiums are not arbitrary. They are calculated to ensure that insurers can meet their obligations even during periods of high claims activity.

Understanding this helps explain why prices vary widely between individuals and why “one-size-fits-all” pricing rarely exists in insurance.

Deductibles and Behavioral Incentives

Deductibles serve a specific purpose beyond cost-sharing. They create a financial incentive for policyholders to avoid small or unnecessary claims.

Without deductibles, insurance systems would be overwhelmed by minor claims, increasing costs for everyone. Deductibles help maintain balance within the risk pool.

Choosing the right deductible is a strategic decision, not just a cost-saving one.

Claims: Where Theory Meets Reality

The claims process is where insurance transitions from theory to real-world impact. This is also where misunderstandings often arise.

Claims are evaluated based on:

- Policy coverage and exclusions

- Evidence and documentation

- Compliance with policy conditions

Most claim disputes stem from coverage misunderstandings rather than bad faith. This is why understanding how claims are assessed is just as important as understanding premiums.

The Role of Regulation in Insurance Operations

Insurance is one of the most regulated industries in the United States. Regulators ensure insurers remain solvent, treat customers fairly, and price products responsibly.

While regulation can slow innovation, it also protects policyholders from systemic risk. Without oversight, insurance systems would be vulnerable to collapse during major loss events.

From an operational standpoint, regulation shapes almost every aspect of how insurance works.

Why Insurance Is Designed for Long-Term Stability

Insurance is not optimized for short-term outcomes. It is designed to remain viable over decades.

Insurers must plan for:

- Economic cycles

- Demographic changes

- Natural disasters

- Legal trends

This long-term focus explains why insurance companies tend to be conservative by design.

The Impact of Technology on How Insurance Works

Technology has introduced major changes to insurance operations. Data analytics, automation, and artificial intelligence have improved underwriting accuracy and claims efficiency.

Digital systems reduce administrative costs and improve transparency. However, they also raise questions about data privacy and algorithmic fairness — areas that continue to evolve.

Despite these challenges, technology has made insurance more responsive and accessible.

Why Understanding Insurance Mechanics Matters

People who understand how insurance really works are better equipped to:

- Choose appropriate coverage

- Avoid underinsurance

- Navigate claims more effectively

- Evaluate policy trade-offs

Insurance becomes far more useful when it is understood as a system rather than a simple transaction.

Common Misunderstandings About How Insurance Works

Some of the most common misconceptions include:

- Insurance companies “keep your money” if you don’t file claims

- Premiums are based on guesswork

- All claims are treated the same

In reality, insurance operates on structured models designed to balance fairness, sustainability, and predictability.

The Big Picture: Why Insurance Works at All

Insurance works because it combines data, discipline, regulation, and trust. When these elements align, insurance provides stability in an uncertain world.

Understanding this broader picture helps demystify insurance and highlights its role as a foundational economic system.

Conclusion

Insurance works not because losses are predictable for individuals, but because they are predictable at scale. By pooling risk, analyzing data, and enforcing structured rules, insurance transforms uncertainty into manageable outcomes.

Looking beyond the basics reveals insurance for what it truly is: a carefully designed system that supports stability, resilience, and long-term planning.