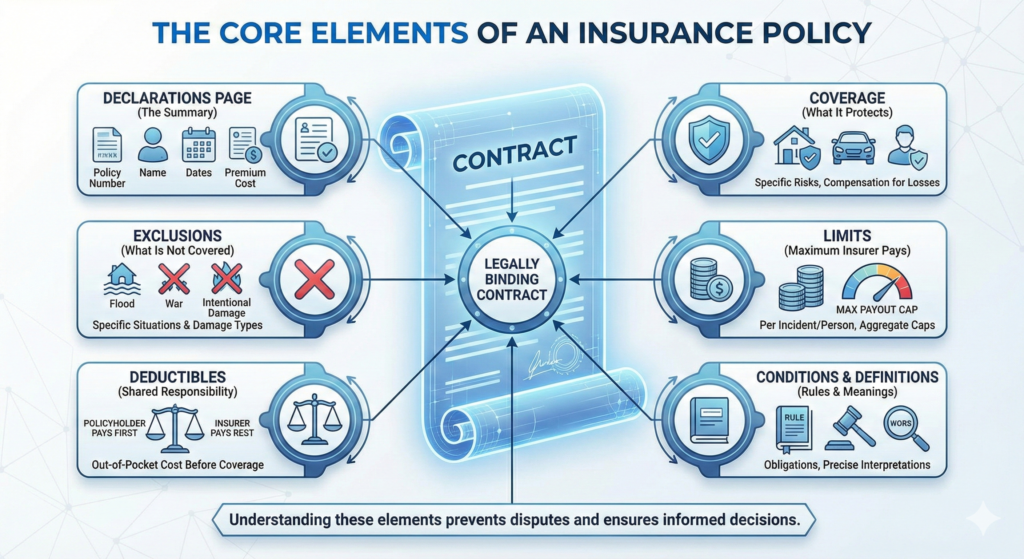

An insurance policy is more than just a document you sign and forget. It is a legally binding contract that defines exactly how protection works, when it applies, and what responsibilities both the insurer and the policyholder have. Despite its importance, many people purchase insurance without fully understanding what their policy actually says.

This lack of understanding is one of the main reasons insurance disputes occur. In most cases, problems do not arise because insurance “doesn’t work,” but because the policyholder did not understand the core elements of the policy itself. Knowing these elements is essential for making informed decisions and avoiding costly surprises.

What an Insurance Policy Really Is

At its foundation, an insurance policy is a contract. It sets the rules under which the insurer agrees to provide financial protection and the conditions the policyholder must meet to maintain that protection.

Every insurance policy, regardless of type, follows a similar structure. While wording and complexity vary, the core elements remain consistent across auto, home, health, life, and business insurance policies.

Understanding these elements allows policyholders to compare coverage accurately and evaluate risk realistically.

Declarations Page: The Policy Summary

The declarations page is usually the first section of an insurance policy. It provides a high-level summary of the most important information.

This section typically includes:

- The name of the insured

- The policy number

- Coverage types and limits

- Deductibles

- Policy term dates

- Premium amount

Many people assume the declarations page tells the whole story. In reality, it is only a snapshot. The full meaning of the coverage depends on the detailed sections that follow.

Coverage: What the Policy Protects

Coverage defines the specific risks the insurer agrees to protect against. This section outlines the events, damages, or losses that qualify for compensation under the policy.

Coverage can include:

- Property damage

- Bodily injury

- Medical expenses

- Legal defense costs

- Loss of income

- Liability claims

Coverage language is often precise and narrow. A risk is only covered if it clearly falls within the definitions provided in the policy. This is why vague assumptions about coverage frequently lead to misunderstandings.

Exclusions: What Is Not Covered

Exclusions are one of the most critical — and most overlooked — elements of an insurance policy. They specify situations, events, or types of damage that the policy does not cover.

Common exclusions might include:

- Certain natural disasters

- Intentional acts

- Wear and tear

- Specific high-risk activities

Exclusions are not hidden tricks. They exist to define the limits of the insurance system and keep premiums affordable. Understanding exclusions is just as important as understanding coverage itself.

Limits: The Maximum the Insurer Will Pay

Policy limits define the maximum amount the insurer will pay for a covered loss. These limits may apply per incident, per person, or over the life of the policy.

For example:

- Auto liability policies often have per-person and per-accident limits

- Property policies may have separate limits for different types of losses

- Liability policies may include aggregate limits

Limits play a major role in determining how well a policy protects against worst-case scenarios. In many cases, policyholders underestimate the financial impact of large losses and choose limits that are too low.

Deductibles: Shared Financial Responsibility

A deductible is the amount the policyholder must pay before insurance coverage applies. Deductibles serve several purposes within the insurance system.

They help:

- Reduce the number of small claims

- Encourage responsible behavior

- Lower premium costs

Choosing a deductible involves balancing affordability with risk tolerance. A low deductible results in higher premiums, while a high deductible increases out-of-pocket exposure during a claim.

Understanding deductibles helps policyholders avoid unexpected financial strain when a loss occurs.

Conditions: Rules That Must Be Followed

Conditions are the rules and obligations that both the insurer and the policyholder must follow. These rules are essential to keeping the policy valid.

Common conditions include:

- Timely payment of premiums

- Prompt reporting of claims

- Cooperation during investigations

- Maintenance of insured property

Failure to meet policy conditions can result in delayed claims, reduced payouts, or denial of coverage. Conditions ensure fairness and consistency in how insurance operates.

Endorsements and Riders: Policy Modifications

Endorsements (or riders) are additions or changes made to the standard policy. They modify coverage, limits, or conditions to address specific needs.

Examples include:

- Adding coverage for valuable items

- Expanding liability protection

- Excluding specific risks

Endorsements allow insurance policies to be customized, but they also increase complexity. Reviewing endorsements carefully is essential to understanding the full scope of coverage.

Definitions: How Words Shape Coverage

Insurance policies rely heavily on precise definitions. Words like “occurrence,” “loss,” or “insured” may have specific meanings that differ from everyday usage.

Definitions determine how coverage applies in real situations. A misunderstanding of a single defined term can significantly change how a claim is evaluated.

For this reason, definitions should never be ignored, even though they are often written in technical language.

Premiums: The Cost of Coverage

The premium is the price paid for insurance coverage. It reflects the insurer’s assessment of risk, operational costs, and regulatory requirements.

Premiums are influenced by:

- Coverage limits

- Deductibles

- Risk factors

- Claims history

- Location and usage patterns

While premiums are often the most visible part of a policy, they should never be the only factor in decision-making. Coverage quality matters more than price alone.

Cancellation and Renewal Provisions

Insurance policies include rules for cancellation and renewal. These provisions explain when and how a policy can be terminated by either party.

Understanding cancellation terms helps avoid coverage gaps. Renewal provisions explain how premiums or terms may change over time.

These sections are particularly important in long-term planning.

Why Understanding Policy Elements Matters

Insurance policies are designed to manage risk, not eliminate it. Understanding the core elements of a policy allows individuals and businesses to align coverage with real-world exposure.

People who understand their policies are more likely to:

- Choose appropriate limits

- Avoid coverage gaps

- Navigate claims confidently

- Make informed comparisons between policies

Insurance works best when both parties clearly understand the agreement.

Conclusion

An insurance policy is a structured agreement built on defined elements: coverage, exclusions, limits, deductibles, conditions, and definitions. Each element plays a specific role in determining how protection works.

By understanding these core components, policyholders can move beyond assumptions and use insurance as an effective tool for financial stability and risk management.