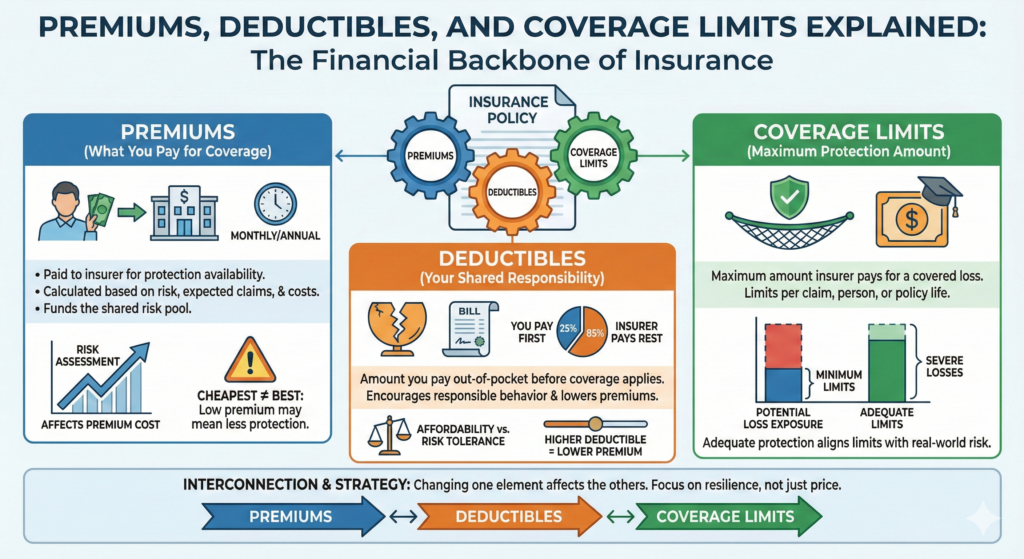

When people talk about insurance, three terms appear again and again: premiums, deductibles, and coverage limits. These concepts form the financial backbone of every insurance policy, yet they are also among the most misunderstood aspects of insurance.

Many policyholders focus almost entirely on the premium — how much they pay each month or year — without fully understanding how deductibles and coverage limits shape real protection. This misunderstanding often leads to unpleasant surprises when a claim occurs.

To truly understand how insurance works, it is essential to understand how these three elements interact and why they exist in the first place.

What Is an Insurance Premium?

A premium is the amount paid to an insurance company in exchange for coverage. It can be paid monthly, quarterly, or annually, depending on the policy and provider.

Premiums are not random prices. They are calculated based on the insurer’s assessment of risk, expected claims, administrative costs, and regulatory requirements. When you pay a premium, you are contributing to a shared pool that funds future claims.

Importantly, paying a premium does not guarantee that you will receive money back. It guarantees that protection will be available if a covered event occurs.

How Insurance Premiums Are Determined

Insurance companies use a process called underwriting to determine premiums. This process evaluates the likelihood and potential cost of future claims.

Factors that influence premiums often include:

- Personal or business risk characteristics

- Location and environment

- Claims history

- Coverage limits selected

- Deductible amount

- Industry or usage patterns

From a systems perspective, premiums reflect probability and expected cost, not individual outcomes. Two people with similar coverage may pay different premiums because their risk profiles differ.

Why Cheaper Premiums Are Not Always Better

One of the most common mistakes people make is choosing insurance based solely on the lowest premium. While affordability matters, low premiums often come with trade-offs.

Lower premiums may mean:

- Higher deductibles

- Lower coverage limits

- Narrower coverage

- More exclusions

In practice, a policy with a low premium may provide insufficient protection in serious situations. Insurance should be evaluated based on how well it protects against worst-case scenarios, not just how little it costs.

What Is a Deductible?

A deductible is the amount the policyholder must pay out of pocket before insurance coverage applies. For example, if a policy has a $1,000 deductible and a covered loss of $5,000 occurs, the policyholder pays the first $1,000 and the insurer pays the remaining $4,000.

Deductibles apply to many types of insurance, including auto, home, health, and business policies. They represent shared financial responsibility between the insurer and the insured.

Why Deductibles Exist

Deductibles serve several important purposes within the insurance system.

They help:

- Reduce the number of small or unnecessary claims

- Encourage responsible behavior

- Lower administrative costs

- Keep premiums affordable

Without deductibles, insurance systems would be overwhelmed by minor claims, increasing costs for everyone. Deductibles help maintain balance within the risk pool.

Choosing the Right Deductible

Selecting a deductible involves balancing affordability and risk tolerance. A higher deductible generally results in a lower premium, while a lower deductible increases premium costs.

The key question is not which deductible is cheapest, but which deductible you can realistically afford to pay if a loss occurs. A deductible that is too high may create financial strain at the worst possible moment.

Understanding personal or business cash flow is essential when choosing deductible levels.

What Are Coverage Limits?

Coverage limits define the maximum amount an insurance company will pay for a covered loss. These limits may apply per claim, per person, or over the life of the policy.

For example:

- Auto liability policies often have limits per injured person and per accident

- Property policies may have separate limits for different categories of damage

- Liability policies may include aggregate limits for the policy period

Coverage limits are one of the most important — and most underestimated — elements of an insurance policy.

Why Coverage Limits Matter More Than Premiums

Coverage limits determine how well a policy protects against severe losses. In many real-world situations, damages can exceed minimum limits by a wide margin.

When limits are too low, policyholders may be personally responsible for costs beyond what insurance pays. This can include medical bills, legal settlements, or property replacement expenses.

From a risk management perspective, coverage limits should be chosen based on potential financial exposure, not minimum legal requirements.

Minimum Limits vs. Adequate Protection

Many policies are purchased at minimum required limits, especially auto insurance. While these limits satisfy legal requirements, they often do not reflect actual financial risk.

Minimum limits are designed to establish a baseline, not comprehensive protection. Serious accidents or lawsuits can quickly exceed these thresholds.

Adequate protection means aligning coverage limits with real-world consequences, including legal and medical costs.

How Premiums, Deductibles, and Limits Work Together

These three elements are interconnected. Changing one usually affects the others.

For example:

- Increasing deductibles often lowers premiums

- Increasing coverage limits typically raises premiums

- Lower limits may reduce premiums but increase risk

Insurance decisions should consider the full structure of the policy, not individual components in isolation.

Understanding this interaction helps policyholders avoid false savings that lead to higher long-term costs.

Common Mistakes Related to Premiums, Deductibles, and Limits

Some of the most frequent mistakes include:

- Choosing the lowest premium without reviewing coverage

- Selecting deductibles that are unaffordable

- Carrying minimum limits without assessing risk

- Assuming all losses will be fully covered

These mistakes are not caused by lack of intelligence, but by lack of clarity. Insurance language is often complex, and many people never receive a clear explanation.

How to Think About These Elements Strategically

A strategic approach to insurance focuses on resilience rather than short-term savings.

Key considerations include:

- Worst-case financial scenarios

- Legal exposure

- Asset protection

- Cash flow stability

From this perspective, premiums are the cost of stability, deductibles are manageable participation, and coverage limits are the ultimate safety net.

The Role of Transparency and Technology

Modern insurance platforms and digital tools have made it easier to visualize premiums, deductibles, and limits. Comparison tools and online dashboards help policyholders understand trade-offs more clearly.

While technology does not eliminate complexity, it improves access to information and supports better decision-making.

Conclusion

Premiums, deductibles, and coverage limits are the core financial elements of every insurance policy. Together, they define how much you pay, how much you share in losses, and how much protection you ultimately receive.

Understanding these elements allows individuals and businesses to move beyond price comparisons and focus on meaningful protection. Insurance works best when it is understood as a system designed to manage risk, not just an expense to minimize.