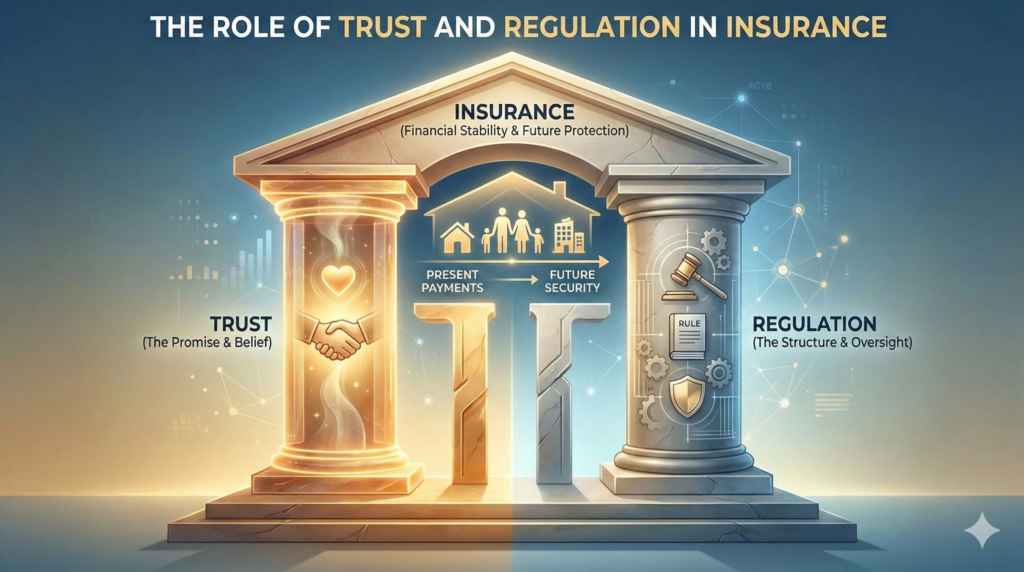

Insurance is built on a promise. Unlike most products or services, its value is not immediately visible. When someone purchases insurance, they are paying today for protection that may only be needed months or even years later. This delayed exchange makes trust the cornerstone of the entire system.

Without trust, insurance cannot function. And without regulation, trust would be difficult to sustain at scale. In the United States and around the world, the insurance industry operates within a carefully structured regulatory environment designed to protect policyholders and maintain financial stability.

Understanding the role of trust and regulation in insurance helps explain why the industry is structured the way it is — and why it must operate differently from many other sectors.

Why Trust Is Fundamental to Insurance

Insurance is not a tangible product. You cannot see it, hold it, or use it immediately after purchase. Instead, you rely on the insurer’s commitment to honor a future obligation.

This creates a unique dynamic:

- The policyholder must trust that the insurer will pay valid claims.

- The insurer must trust that the policyholder has provided accurate information.

- Both parties rely on clearly defined rules.

If policyholders believe insurers will not pay claims fairly, confidence collapses. If insurers cannot rely on accurate information from applicants, pricing becomes unstable.

Trust, therefore, is not optional — it is structural.

The Long-Term Nature of Insurance Commitments

Insurance contracts often extend over long periods. Life insurance policies may last decades. Business insurance relationships may continue for years. Even annual policies depend on renewal expectations and consistent standards.

Because obligations may arise long after premiums are paid, insurers must maintain financial strength and operational discipline over time. Policyholders need confidence that the company they choose today will remain solvent and reliable in the future.

This long-term dimension makes regulation essential.

The Purpose of Insurance Regulation

Insurance regulation exists to protect consumers and maintain market stability. In the United States, insurance is primarily regulated at the state level. Each state has its own insurance department responsible for oversight and enforcement.

Regulators focus on several key objectives:

- Ensuring insurers remain financially solvent

- Protecting consumers from unfair practices

- Reviewing policy forms and pricing structures

- Monitoring claims handling standards

- Preventing fraud

These safeguards help maintain balance between consumer protection and industry sustainability.

Solvency and Financial Stability

One of the most important roles of regulation is ensuring that insurance companies remain financially capable of paying claims.

Regulators require insurers to:

- Maintain sufficient capital reserves

- File regular financial reports

- Undergo audits and stress testing

- Follow strict accounting standards

Without these safeguards, an insurer could collect premiums without being prepared to handle large-scale losses. Solvency requirements reduce systemic risk and protect policyholders from unexpected company failures.

Consumer Protection and Fair Practices

Regulation also establishes standards for how insurers interact with customers. This includes:

- Clear policy language

- Transparent pricing

- Timely claims processing

- Fair dispute resolution procedures

While no system is perfect, regulatory frameworks provide mechanisms for addressing complaints and enforcing accountability.

These protections reinforce trust by ensuring that insurers operate within established boundaries.

The Balance Between Innovation and Oversight

Insurance is increasingly influenced by technology. Digital platforms, automated underwriting, and data analytics are transforming how risk is assessed and managed.

However, innovation must operate within regulatory constraints. Automated systems must comply with fairness standards. Data usage must respect privacy laws. Pricing models must remain transparent and defensible.

Regulators play a key role in ensuring that technological advancements do not undermine consumer protections. At the same time, excessive regulation can slow innovation. Maintaining balance is an ongoing challenge.

Transparency as a Trust Mechanism

Transparency strengthens trust. When policy terms are clearly explained and claims processes are understandable, policyholders feel more confident in their coverage.

Modern insurers increasingly use digital tools to improve transparency. Online dashboards, policy summaries, and real-time updates provide greater visibility into coverage and claims status.

Clear communication reduces misunderstandings and builds long-term relationships between insurers and customers.

Fraud Prevention and System Integrity

Insurance systems rely on accurate information. Fraud — whether intentional misrepresentation by applicants or exaggerated claims — undermines trust and increases costs for everyone.

Regulation supports fraud prevention through:

- Reporting requirements

- Investigation standards

- Penalties for misconduct

Fraud prevention protects honest policyholders and preserves the stability of risk pools.

The Global Perspective on Insurance Regulation

While insurance is regulated at the state level in the US, international standards also influence industry practices. Global financial oversight bodies establish guidelines for capital requirements, risk management, and transparency.

This broader framework supports stability across borders, especially for insurers operating in multiple jurisdictions.

Regulation is not designed to limit access to insurance but to ensure that access remains reliable and sustainable.

Why Trust Matters More Than Ever

In an increasingly digital environment, trust becomes even more important. Customers often purchase policies online without face-to-face interaction. Claims may be submitted through mobile apps. Automated systems may evaluate risk in seconds.

While technology increases efficiency, it also requires strong oversight and clear communication. Trust must be reinforced through transparency, regulatory compliance, and consistent service standards.

Insurance companies that prioritize trust tend to build stronger, more durable relationships with policyholders.

What Policyholders Should Understand

For policyholders, understanding the role of trust and regulation provides valuable perspective. Insurance is not simply a transaction; it is participation in a regulated financial system designed to manage risk collectively.

Consumers can strengthen their position by:

- Reviewing policy documents carefully

- Understanding state-level protections

- Verifying insurer financial strength

- Asking questions when terms are unclear

Engaged and informed policyholders contribute to a healthier insurance ecosystem.

The Future of Trust and Regulation in Insurance

As technology continues to reshape insurance, regulation will evolve alongside it. Artificial intelligence, big data, and predictive analytics introduce both opportunities and ethical considerations.

Future regulatory frameworks will likely focus on:

- Data privacy

- Algorithmic transparency

- Consumer digital rights

- Climate-related risk exposure

The goal will remain the same: maintaining trust while allowing responsible innovation.

Conclusion

Trust and regulation are the pillars that support the insurance industry. Trust ensures that policyholders believe in the promise of protection. Regulation ensures that insurers operate responsibly and remain financially capable of fulfilling that promise.

Together, they create a structured environment where risk can be managed effectively and fairly. In a system built on future commitments, these foundations are not optional — they are essential.