Insurance is a key pillar of financial security and risk management. Understanding the basics—how insurance works, the different types available, and the role of technology in shaping the industry—helps you make informed decisions for yourself, your family, and your business.

This category covers the essential foundations of insurance, offering clear explanations of policies, premiums, risk evaluation, and regulations. Whether you are new to insurance or looking to deepen your knowledge, this hub is your starting point.

What You Will Learn in This Category

- What Is Insurance? – Discover the purpose of insurance and its role in protecting people and businesses.

- Why Insurance Is Essential in the United States – Learn why insurance is a critical part of financial planning and legal compliance.

- How Insurance Really Works (Beyond the Basics) – Understand how policies function in real-life scenarios, beyond just premiums and coverage.

- The Core Elements of an Insurance Policy – Explore coverage types, exclusions, and the essential components of a policy.

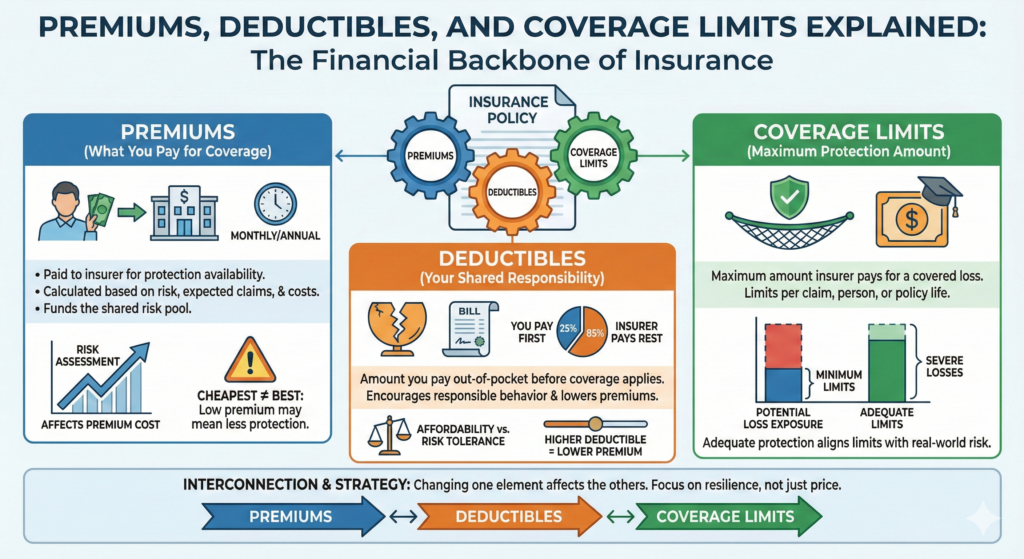

- Premiums, Deductibles, and Coverage Limits Explained – Break down the financial mechanics behind insurance.

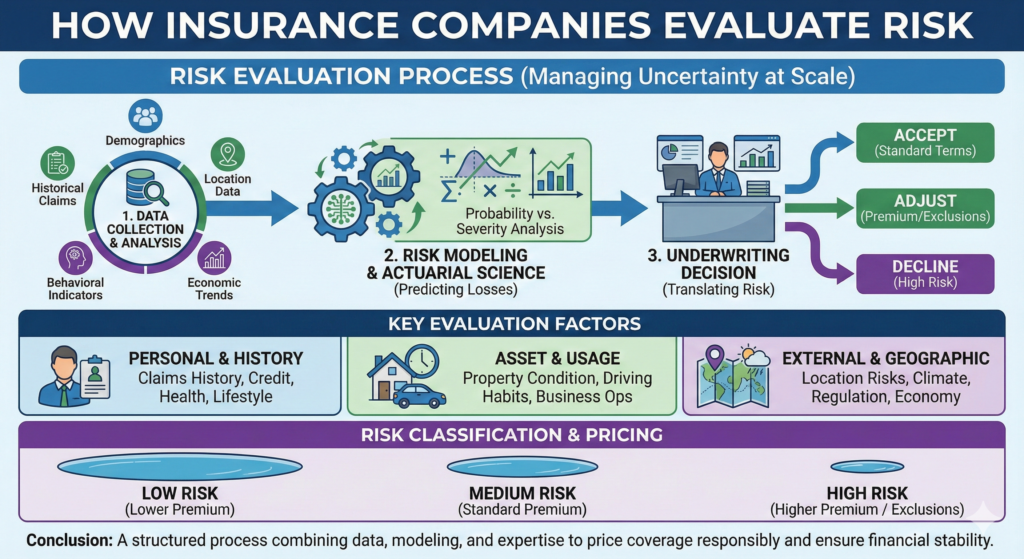

- How Insurance Companies Evaluate Risk – Learn about underwriting, actuarial models, and risk assessment.

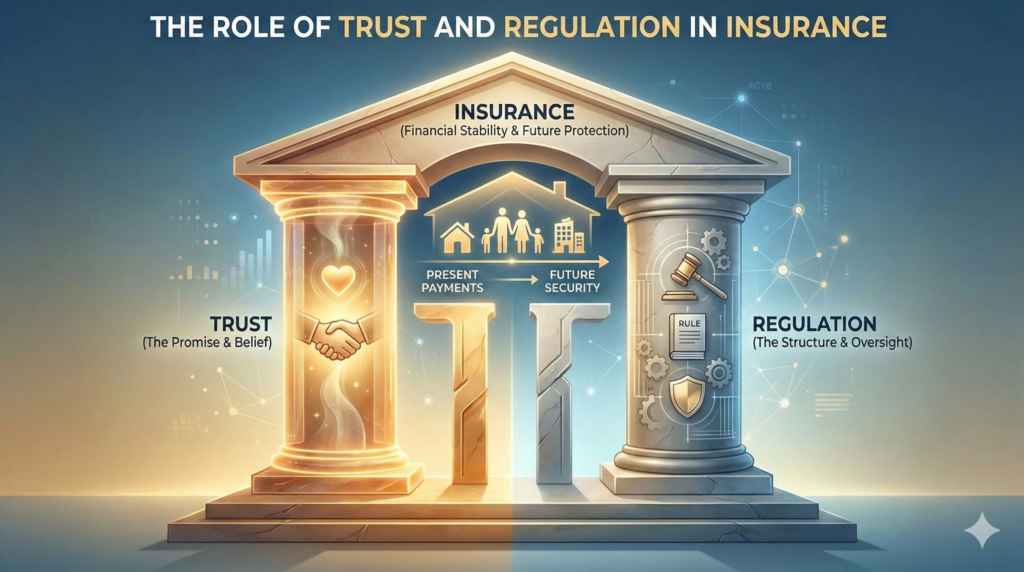

- The Role of Trust and Regulation in Insurance – Understand how trust and regulation ensure the safety and reliability of insurance providers.

Why Explore This Category?

- Easy Navigation: Each topic is organized for clear understanding and quick access.

- Practical Knowledge: Gain insights that can guide real-world insurance decisions.

- SEO-Friendly Hub: Structured headings make it easy for search engines and readers to find information.

- Ad Placement Ready: Space for banners or inline ads without disrupting the reading experience.

Posts in This Category

Below, you will find all articles covering the fundamentals of insurance.

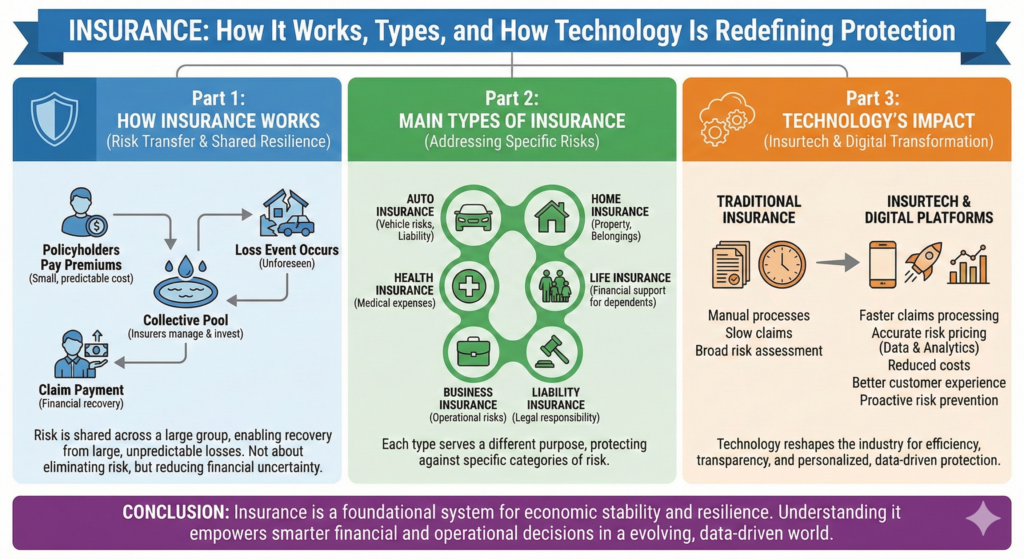

- Insurance: How It Works, Types, and How Technology Is Redefining ProtectionInsurance plays a critical role in modern society, yet it remains one of the most misunderstood financial tools. Most people interact with insurance only when they are required to —… Read more: Insurance: How It Works, Types, and How Technology Is Redefining Protection

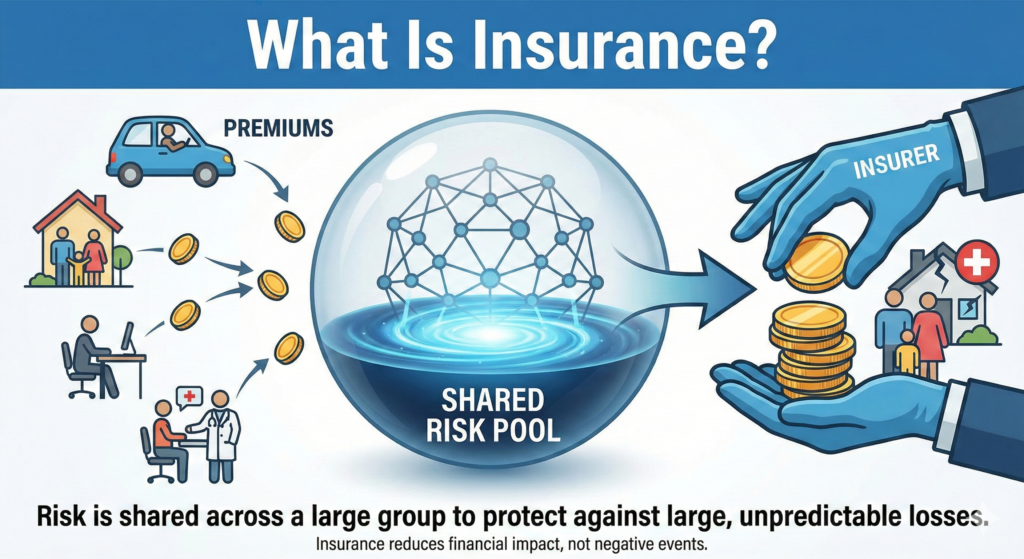

- What Is Insurance?Insurance is a concept that most people are familiar with, yet few fully understand. It is often seen as a requirement imposed by law or an unavoidable monthly expense. In… Read more: What Is Insurance?

- Why Insurance Is Essential in the United StatesIn the United States, insurance is not just a financial product — it is a fundamental part of everyday life. From driving a car to owning a home, starting a… Read more: Why Insurance Is Essential in the United States

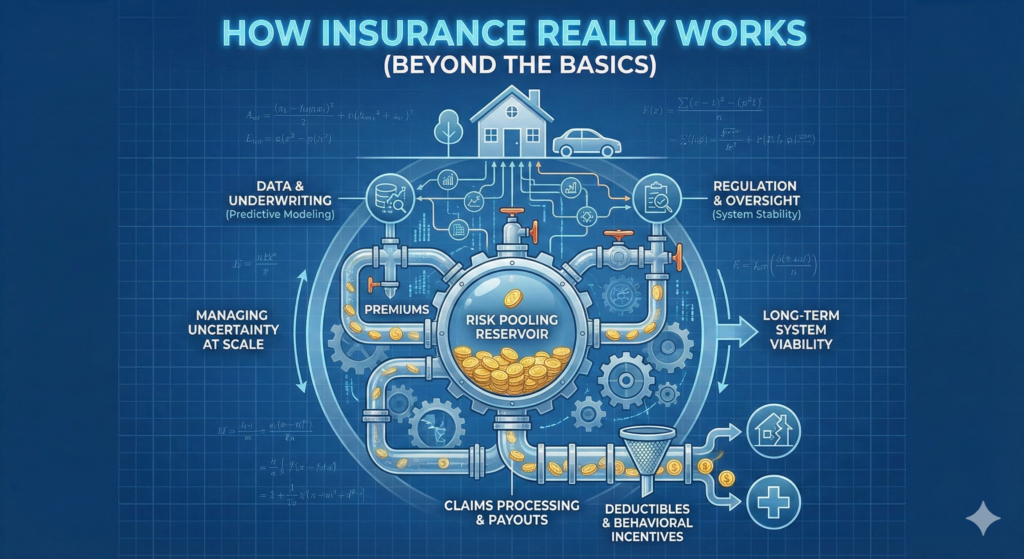

- How Insurance Really Works (Beyond the Basics)Most explanations of insurance stop at simple definitions: you pay a premium, and the insurance company pays if something goes wrong. While this description is technically correct, it barely scratches… Read more: How Insurance Really Works (Beyond the Basics)

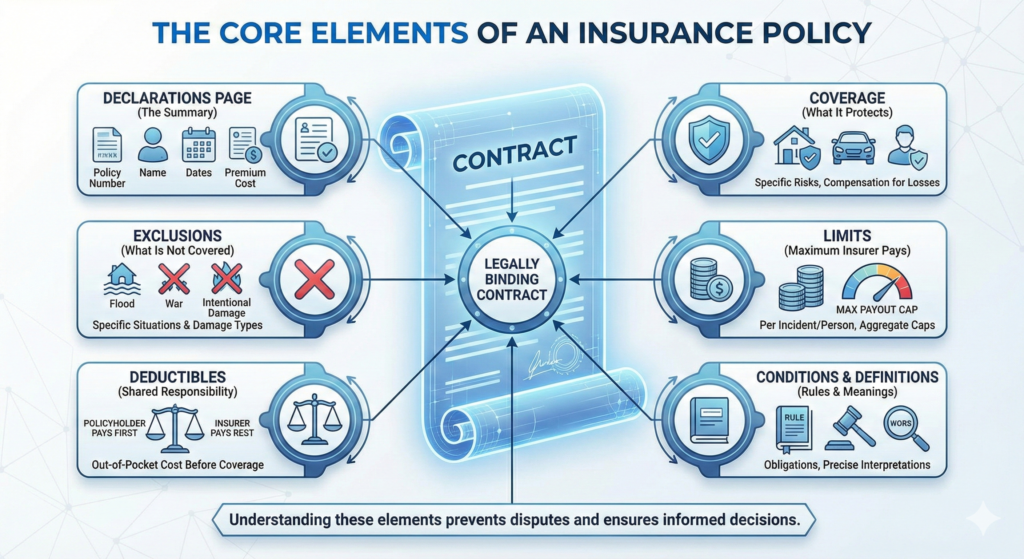

- The Core Elements of an Insurance PolicyAn insurance policy is more than just a document you sign and forget. It is a legally binding contract that defines exactly how protection works, when it applies, and what… Read more: The Core Elements of an Insurance Policy

- Premiums, Deductibles, and Coverage Limits ExplainedWhen people talk about insurance, three terms appear again and again: premiums, deductibles, and coverage limits. These concepts form the financial backbone of every insurance policy, yet they are also… Read more: Premiums, Deductibles, and Coverage Limits Explained

- How Insurance Companies Evaluate RiskRisk evaluation is the foundation of the insurance industry. Every policy issued, every premium charged, and every coverage decision made by an insurance company is based on how risk is… Read more: How Insurance Companies Evaluate Risk

- The Role of Trust and Regulation in InsuranceInsurance is built on a promise. Unlike most products or services, its value is not immediately visible. When someone purchases insurance, they are paying today for protection that may only… Read more: The Role of Trust and Regulation in Insurance