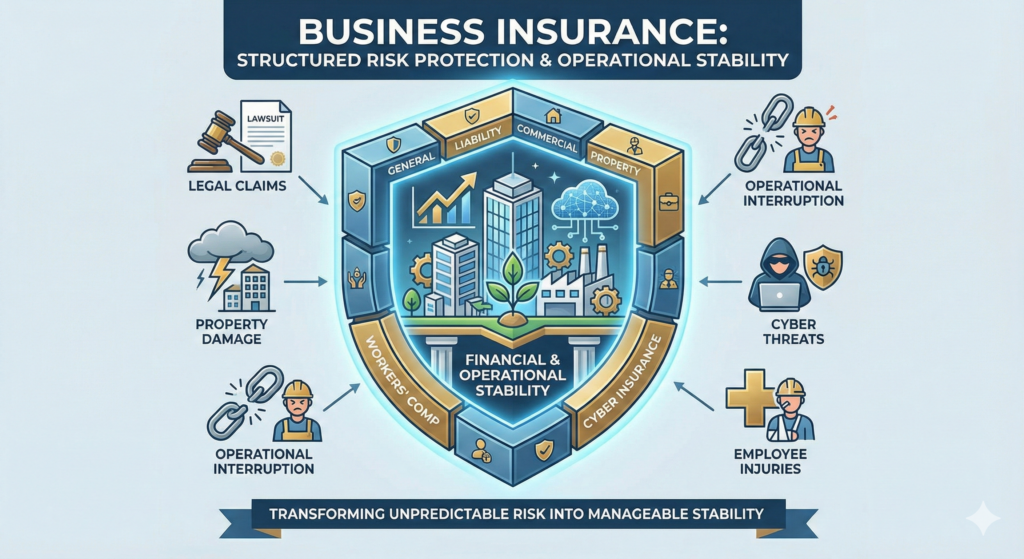

Business insurance is a structured form of risk protection designed to safeguard companies from financial losses resulting from unexpected events. Whether operating as a small startup, a growing technology company, or an established enterprise, every business faces risk. These risks may arise from property damage, legal claims, employee injuries, operational interruptions, or digital threats.

Unlike personal insurance, business insurance is often more complex because companies operate in dynamic environments. They interact with customers, employees, vendors, and regulatory systems. Each interaction introduces potential exposure.

Understanding business insurance is essential for responsible entrepreneurship and long-term operational stability.

Why Business Insurance Matters

Running a business involves uncertainty. Even well-managed companies can experience:

- Accidental property damage

- Workplace injuries

- Lawsuits from customers or third parties

- Equipment breakdown

- Data breaches

- Supply chain disruptions

Without insurance, these events could result in significant financial strain or even business closure.

Business insurance transforms unpredictable financial risk into a manageable expense through structured premium payments.

Core Types of Business Insurance

Business insurance is not a single policy but a collection of coverage options designed to address specific exposures. The most common forms include the following.

General Liability Insurance

General liability insurance is one of the most fundamental types of business coverage. It protects against claims involving:

- Bodily injury to third parties

- Property damage

- Advertising injury

- Legal defense costs

For example, if a customer slips and falls at a retail store, general liability coverage may help cover medical expenses and legal claims.

This type of insurance is often required by landlords, vendors, or contractual agreements.

Commercial Property Insurance

Commercial property insurance protects physical business assets such as:

- Office buildings

- Equipment

- Inventory

- Furniture

- Machinery

If property is damaged due to covered events like fire or theft, the policy may help repair or replace assets.

Replacement cost and actual cash value coverage options should be carefully evaluated when selecting this policy.

Business Interruption Insurance

Business interruption insurance helps cover lost income if operations are temporarily halted due to a covered event.

For example, if a fire damages a facility and forces closure, this coverage may help offset:

- Lost revenue

- Ongoing expenses

- Temporary relocation costs

Business interruption coverage is often included as an endorsement to property insurance policies.

Workers’ Compensation Insurance

Workers’ compensation insurance provides coverage for employees who experience work-related injuries or illnesses.

In most states, this coverage is legally required for businesses with employees. It typically covers:

- Medical expenses

- Rehabilitation costs

- Partial wage replacement

Workers’ compensation helps protect both employees and employers by providing structured benefits and limiting litigation exposure.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, protects businesses that provide services or professional advice.

This coverage applies when clients allege:

- Negligence

- Mistakes

- Failure to deliver promised services

It is particularly important for consultants, technology providers, legal professionals, and financial advisors.

Commercial Auto Insurance

If a business owns or operates vehicles, commercial auto insurance provides coverage for:

- Vehicle damage

- Liability claims

- Driver-related incidents

Personal auto insurance typically does not cover business use.

Cyber Insurance

In today’s digital economy, cyber insurance has become increasingly important. Businesses that store customer data or rely on digital infrastructure face exposure to:

- Data breaches

- Ransomware attacks

- System failures

- Regulatory penalties

Cyber insurance may help cover investigation costs, legal expenses, notification requirements, and business interruption due to cyber incidents.

As digital transformation accelerates, cyber risk management has become central to business continuity planning.

How Insurers Evaluate Business Risk

Insurance providers assess several factors when determining business insurance premiums:

- Industry classification

- Business size and revenue

- Location

- Claims history

- Number of employees

- Operational complexity

High-risk industries may face higher premiums due to increased likelihood of claims.

Risk mitigation strategies, such as safety protocols and cybersecurity measures, may positively influence underwriting assessments.

Coverage Limits and Deductibles

Business insurance policies include coverage limits that define maximum payouts. Selecting appropriate limits is critical, especially for liability coverage where legal claims can be substantial.

Deductibles represent the portion of a claim the business must pay before insurance coverage applies.

Balancing deductible levels with premium affordability is an important financial planning decision.

Business Insurance for Startups

Startups and emerging businesses often assume they are too small to require comprehensive coverage. However, early-stage companies frequently face unique risks, particularly in technology-driven sectors.

For example:

- Software companies may require professional liability and cyber insurance

- E-commerce businesses may need product liability coverage

- Remote-first companies may face data security risks

Business insurance supports credibility when dealing with investors, partners, and clients. Many contracts require proof of coverage before collaboration begins.

Regulatory and Contractual Requirements

Certain types of business insurance are mandated by law, such as workers’ compensation in most states.

Additionally, contracts with clients, landlords, or government entities often require specific coverage levels.

Failing to maintain required coverage can lead to penalties or lost business opportunities.

The Role of Technology in Business Insurance

Technology has modernized how business insurance is purchased and managed. Digital platforms allow companies to:

- Obtain quotes online

- Compare coverage options

- Manage policies digitally

- Submit claims electronically

Advanced data analytics also enable insurers to better assess industry trends and customize coverage.

Digital innovation has increased transparency while streamlining underwriting processes.

Business Insurance as a Risk Management Strategy

Business insurance should not be viewed merely as an expense. It is a strategic component of risk management.

By transferring certain financial risks to an insurer, business owners can focus on growth, innovation, and operational development.

Insurance does not eliminate risk — it redistributes it within a structured framework.

Companies that integrate insurance into broader financial planning are often better positioned to handle unexpected disruptions.

When to Review Business Insurance Coverage

Business insurance should be reviewed regularly, especially after:

- Revenue growth

- Hiring employees

- Expanding locations

- Launching new products

- Entering new markets

As businesses evolve, their risk profiles change. Periodic review ensures coverage remains aligned with operational realities.

Conclusion

Business insurance provides essential financial protection against operational risks, legal exposure, property damage, and digital threats. Whether operating as a small startup or a large enterprise, companies benefit from structured coverage that transforms unpredictable risks into manageable expenses.

Understanding general liability, property insurance, workers’ compensation, professional liability, and cyber insurance helps business owners make informed decisions. When integrated into long-term strategy, business insurance becomes a foundational pillar of operational stability and sustainable growth.