Health insurance is one of the most important — and often most complex — forms of insurance in the United States. Unlike many other types of coverage, health insurance directly affects access to medical care, prescription medications, preventive services, and emergency treatment.

In a country where healthcare costs can be significant, health insurance plays a critical role in protecting individuals and families from overwhelming medical expenses. Understanding how health insurance works, what it covers, and how to evaluate different plans is essential for making informed decisions.

While the terminology can seem complicated at first, breaking health insurance down into its core components makes it easier to understand.

Why Health Insurance Is Essential in the United States

Healthcare in the United States is largely privately funded. Without insurance, patients are typically responsible for the full cost of medical services, which may include:

- Doctor visits

- Hospital stays

- Surgical procedures

- Diagnostic testing

- Prescription medications

- Emergency treatment

Even routine medical care can become expensive over time. Health insurance spreads these costs across a large group of insured individuals, making healthcare more financially manageable.

In addition to financial protection, health insurance often provides access to preventive services, which can help detect and treat health conditions early.

How Health Insurance Works

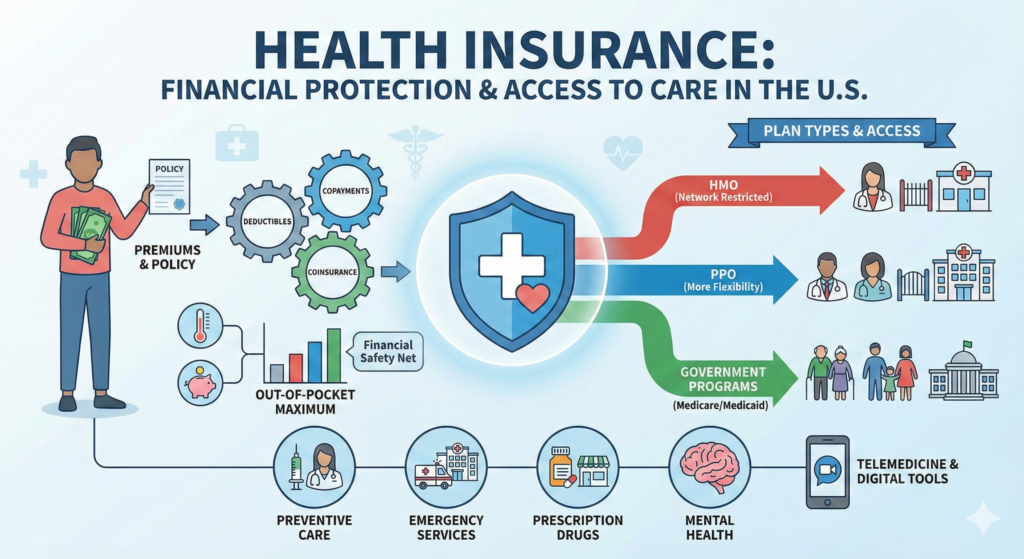

Health insurance operates through a contract between the insured individual and the insurance provider. The policyholder pays a premium, and in return, the insurer agrees to cover a portion of eligible medical expenses.

Most health insurance plans include cost-sharing components such as:

- Deductibles – The amount the insured must pay before coverage begins

- Copayments (copays) – Fixed amounts paid for specific services

- Coinsurance – A percentage of the cost shared between the insurer and the insured

- Out-of-pocket maximums – The maximum amount a policyholder must pay during a coverage period

Once the out-of-pocket maximum is reached, the insurer typically covers 100% of covered services for the remainder of the policy year.

Types of Health Insurance Plans

There are several common types of health insurance plans in the United States. Each has different rules regarding provider networks and cost-sharing.

Health Maintenance Organization (HMO)

HMO plans require members to use a network of doctors and hospitals. Referrals from a primary care physician are usually required to see specialists.

HMO plans often have lower premiums but less flexibility in choosing providers.

Preferred Provider Organization (PPO)

PPO plans offer greater flexibility. Policyholders can visit providers outside the network, though at higher cost.

These plans typically have higher premiums but fewer restrictions.

Exclusive Provider Organization (EPO)

EPO plans combine elements of HMOs and PPOs. They require in-network care but generally do not require referrals for specialists.

Point of Service (POS)

POS plans require referrals like HMOs but allow out-of-network care at higher costs, similar to PPOs.

Understanding plan types is important because network restrictions significantly affect access and costs.

Employer-Sponsored Health Insurance

Many Americans receive health insurance through their employers. Employers often share the cost of premiums, making coverage more affordable for employees.

Employer-sponsored plans may offer group pricing advantages and broader access to benefits.

However, coverage may be limited to employment status. Losing or changing jobs can affect access to employer-sponsored plans.

Individual and Marketplace Plans

Individuals who do not receive employer-sponsored insurance can purchase coverage through the Health Insurance Marketplace.

Marketplace plans are categorized into metal tiers:

- Bronze

- Silver

- Gold

- Platinum

These tiers reflect cost-sharing structures rather than quality of care. Bronze plans typically have lower premiums but higher out-of-pocket costs, while Platinum plans have higher premiums and lower cost-sharing.

Understanding these tiers helps consumers balance monthly costs with potential medical expenses.

Government Health Insurance Programs

Several public programs provide health insurance in the United States:

- Medicare – For individuals aged 65 and older or those with certain disabilities

- Medicaid – For eligible low-income individuals and families

- Children’s Health Insurance Program (CHIP) – For eligible children

These programs play a critical role in expanding access to healthcare.

What Health Insurance Typically Covers

Most health insurance plans cover:

- Preventive services (such as vaccinations and screenings)

- Doctor visits

- Hospitalization

- Emergency services

- Prescription drugs

- Mental health services

However, coverage specifics vary. Reviewing plan documents is essential to understand included benefits and limitations.

Common Health Insurance Exclusions

Health insurance policies may exclude certain services, such as:

- Experimental treatments

- Cosmetic procedures (unless medically necessary)

- Certain elective services

Pre-authorization requirements may also apply for specific treatments.

Understanding exclusions helps avoid unexpected medical bills.

Factors That Affect Health Insurance Premiums

Premiums are influenced by factors such as:

- Age

- Geographic location

- Tobacco use

- Plan type

- Coverage level

Under current regulations, insurers cannot deny coverage or charge higher premiums based solely on pre-existing conditions.

The Importance of Preventive Care

Health insurance often emphasizes preventive care. Regular checkups, screenings, and vaccinations help detect potential health issues early.

Preventive care reduces long-term healthcare costs and improves overall health outcomes.

Technology and Health Insurance

Digital tools have improved access to health insurance information. Many insurers offer:

- Online portals

- Mobile apps

- Telemedicine services

- Digital claims tracking

Telehealth has expanded access to care, particularly in rural or underserved areas.

Technology enhances convenience while maintaining structured coverage systems.

Why Understanding Health Insurance Matters

Health insurance is not just a monthly expense; it is a critical component of financial planning and personal wellbeing.

Understanding how premiums, deductibles, copays, and networks work allows individuals to:

- Compare plans effectively

- Anticipate medical costs

- Avoid coverage gaps

- Make informed healthcare decisions

The more informed a policyholder is, the more effectively they can use their coverage.

Conclusion

Health insurance is a foundational element of the healthcare system in the United States. It provides financial protection against medical expenses while expanding access to preventive and essential services.

Although health insurance can appear complex, understanding its structure — including premiums, deductibles, plan types, and coverage rules — empowers individuals to make informed and responsible decisions.

Rather than viewing health insurance as simply another expense, it should be seen as a structured safeguard against medical and financial uncertainty.