Choosing insurance is not just about selecting a policy — it is about making informed strategic decisions that impact your financial stability, risk exposure, and long-term planning.

This category goes beyond definitions and technical explanations. It explores how real decisions are made, what mistakes people commonly make, and how professionals approach insurance as a strategic financial tool rather than just a mandatory expense.

If you want to think about insurance the way experts do, this section is your roadmap.

What You Will Learn in This Category

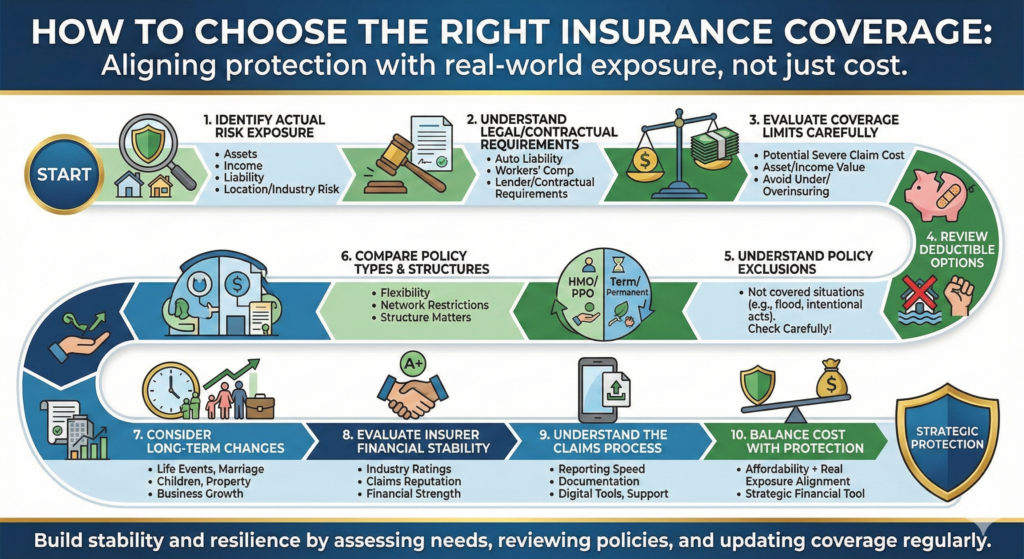

- How to Choose the Right Insurance Coverage – A structured framework to evaluate your needs and select appropriate protection.

- Common Insurance Mistakes Most People Make – Identify costly errors and learn how to avoid them.

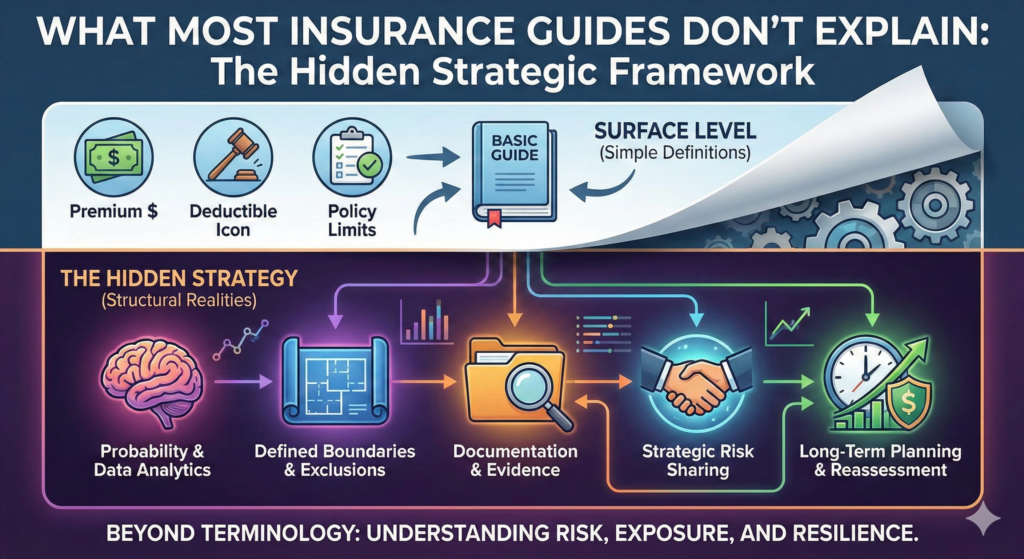

- What Most Insurance Guides Don’t Explain – Insights that go beyond generic advice and surface-level explanations.

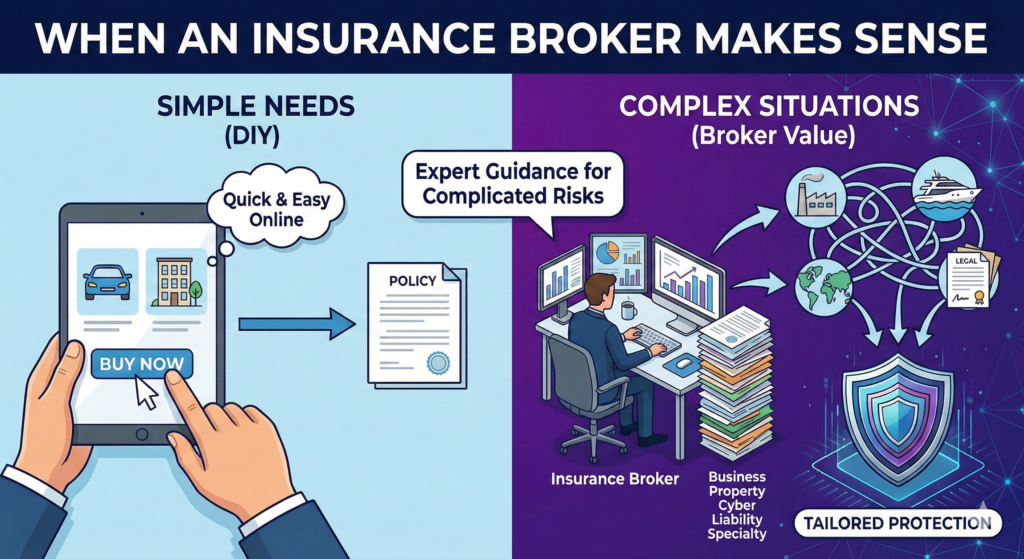

- When an Insurance Broker Actually Makes Sense – Understand when professional intermediation adds value — and when it doesn’t.

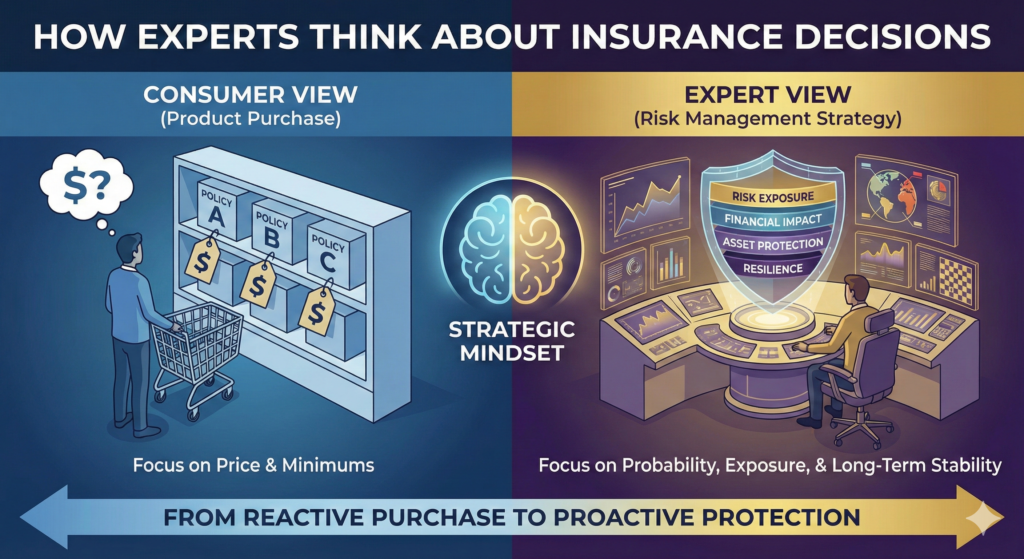

- How Experts Think About Insurance Decisions – Discover the mindset and evaluation process used by experienced professionals.

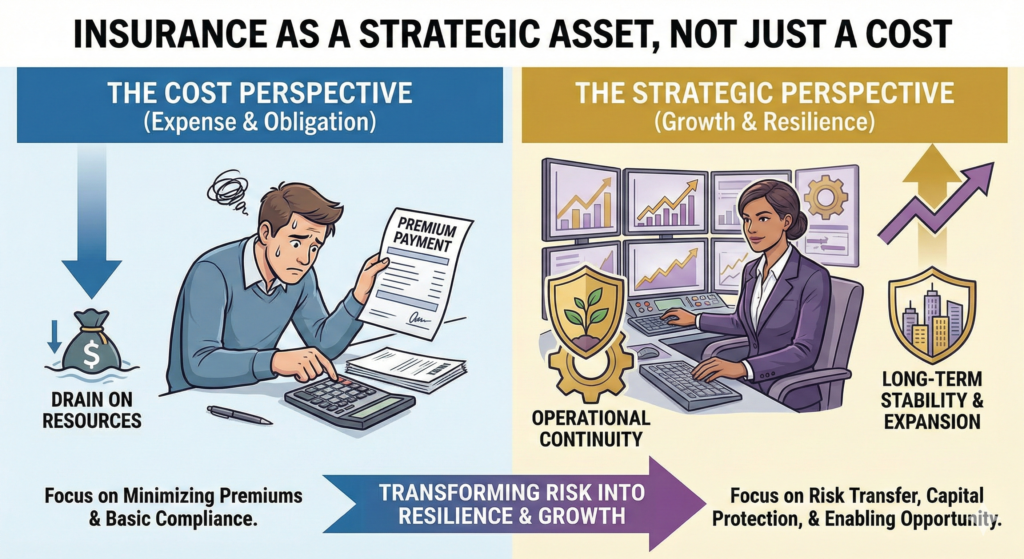

- Insurance as a Strategic Asset, Not Just a Cost – Learn how insurance can be integrated into broader financial and business strategy.

Why This Category Matters

- Decision-Focused: Moves from theory to real-world application.

- Strategic Perspective: Treat insurance as part of financial architecture.

- Risk-Based Thinking: Understand opportunity cost, exposure, and protection alignment.

- AdSense-Ready Structure: Clear sections allow for natural ad placement between post grids or after introduction.

Who Should Read This Section?

- Individuals making major financial decisions

- Entrepreneurs and business owners

- Professionals reviewing coverage portfolios

- Anyone who wants to move from reactive buying to strategic protection planning

Posts in This Category

Below you will find all articles focused on real insurance decisions and expert-level perspectives.

- How to Choose the Right Insurance CoverageChoosing the right insurance coverage can feel overwhelming. With so many policy types, coverage limits, deductibles, and exclusions, it is easy to focus only on price. However, selecting insurance based… Read more: How to Choose the Right Insurance Coverage

- Common Insurance Mistakes Most People MakeInsurance is designed to protect against financial risk. However, many individuals and business owners make avoidable mistakes when purchasing or managing their policies. These errors often stem from misunderstandings, rushed… Read more: Common Insurance Mistakes Most People Make

- What Most Insurance Guides Don’t ExplainMost insurance guides focus on definitions. They explain what a premium is, what a deductible means, and how coverage limits work. While those basics are important, they often leave out… Read more: What Most Insurance Guides Don’t Explain

- When an Insurance Broker Actually Makes SenseIn today’s digital world, buying insurance can seem straightforward. Many companies offer instant online quotes, policy comparisons, and digital policy management tools. Because of this accessibility, some people question whether… Read more: When an Insurance Broker Actually Makes Sense

- How Experts Think About Insurance DecisionsMost people approach insurance as a product purchase. Experts approach it as a risk management strategy. This difference in mindset changes everything. While consumers often focus on price comparisons and… Read more: How Experts Think About Insurance Decisions

- Insurance as a Strategic Asset, Not Just a CostFor many individuals and business owners, insurance is viewed primarily as an expense — a recurring payment that feels obligatory rather than beneficial. Premiums are often evaluated in the same… Read more: Insurance as a Strategic Asset, Not Just a Cost

"Make smarter insurance decisions by understanding the strategy behind protection — not just the policy."