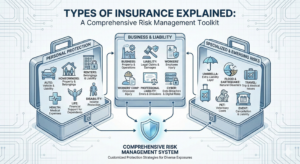

Insurance comes in many forms, each designed to protect different aspects of your life, health, business, or digital presence. Understanding the types of insurance available helps you make informed decisions and ensures you are properly covered for any risk.

This category covers the main types of insurance, from common personal policies to specialized and niche products, providing clear explanations and practical insights.

Explore the Types of Insurance

- Types of Insurance Explained – A comprehensive overview of insurance categories and their purposes.

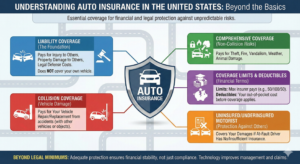

- Auto Insurance – Protection for your vehicle against accidents, theft, or damage.

- Home Insurance – Coverage for your home, personal belongings, and liability.

- Health Insurance – Access to medical care and protection against healthcare costs.

- Life Insurance – Financial security for your loved ones in case of unexpected events.

- Business Insurance – Safeguarding businesses against operational, financial, and legal risks.

- Liability Insurance – Coverage for legal responsibilities and potential lawsuits.

- Disability and Income Protection – Protects your income in case of injury or illness.

- Cyber Insurance for Digital Businesses – Coverage for cyber risks, data breaches, and digital operations.

- Specialty and Niche Insurance Products – Policies tailored to unique or industry-specific risks.

Why Explore This Category?

- Structured Learning: Understand each type of insurance and its purpose.

- Practical Applications: Learn which policies apply to you personally, professionally, or digitally.

- SEO Optimized: H2 and H3 headings align with key search terms like “Auto Insurance”, “Health Insurance”, “Business Insurance”, etc.

- AdSense Ready: Space for banners or inline ads between sections or posts.

Posts in This Category

Below you will find all articles covering different types of insurance.

- Types of Insurance ExplainedInsurance is not a single product. It is a broad category of financial protection designed to address many different types of risk. While the basic concept of insurance remains the… Read more: Types of Insurance Explained

- Auto InsuranceAuto insurance is one of the most common and essential types of insurance in the United States. For most drivers, it is not optional. Nearly every state requires a minimum… Read more: Auto Insurance

- Home InsuranceHome insurance, also known as homeowners insurance, is one of the most important forms of financial protection for property owners in the United States. For most people, a home is… Read more: Home Insurance

- Health InsuranceHealth insurance is one of the most important — and often most complex — forms of insurance in the United States. Unlike many other types of coverage, health insurance directly… Read more: Health Insurance

- Life InsuranceLife insurance is a financial protection tool designed to provide economic support to designated beneficiaries after the death of the insured person. While it may not be a topic people… Read more: Life Insurance

"Explore all types of insurance to ensure you are fully protected in every aspect of life and business."