Insurance is a concept that most people are familiar with, yet few fully understand. It is often seen as a requirement imposed by law or an unavoidable monthly expense. In reality, insurance is a fundamental system that supports financial stability, personal security, and economic growth.

Understanding what insurance is — and what it is not — is essential for making informed decisions, whether you are an individual, a family, or a business owner. This article explains insurance in clear terms, without technical jargon, and provides a solid foundation for understanding how it fits into modern life.

The Basic Definition of Insurance

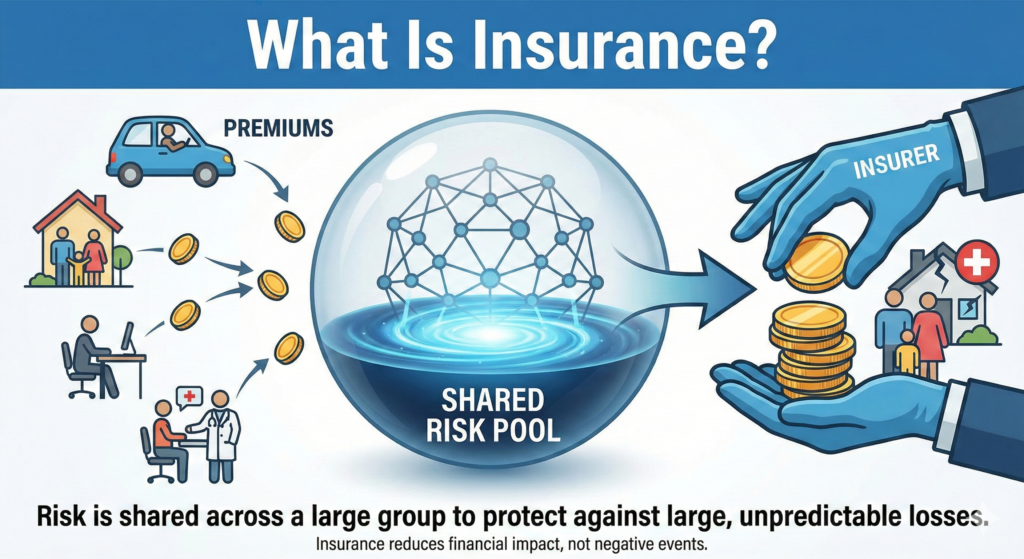

At its simplest level, insurance is a financial arrangement that protects against loss. An individual or organization pays a fee, known as a premium, to an insurance company. In return, the insurer agrees to cover certain financial losses that may occur due to specific events.

These events might include accidents, illnesses, property damage, legal claims, or other unexpected situations. Instead of facing the full financial impact alone, the insured shares that risk with a larger group.

Insurance does not prevent negative events from happening. What it does is reduce the financial consequences when they occur.

Insurance as a Risk Management Tool

Insurance is best understood as a form of risk management. Risk is a natural part of life — driving a car, owning a home, running a business, or even earning an income all involve uncertainty.

Rather than eliminating risk, insurance helps manage it by transferring the financial burden to an insurer. This allows individuals and organizations to plan for the future without being exposed to catastrophic losses from a single event.

From an expert perspective, the true value of insurance lies not in how often it is used, but in the protection it provides when it is needed most.

How Insurance Works Behind the Scenes

Insurance operates on a principle known as risk pooling. Many people pay premiums into a shared pool. Only a small percentage of them will experience a covered loss at any given time.

Because insurers can predict loss patterns using historical data and statistical models, they are able to estimate how much money is needed to cover claims while remaining financially stable. This process is known as underwriting.

The success of the insurance system depends on accurate data, responsible pricing, and trust between insurers and policyholders.

The Insurance Policy Explained

An insurance policy is a legally binding contract. It outlines the rights and responsibilities of both the insurer and the insured.

Most insurance policies include several key components:

- Coverage: What risks are protected

- Exclusions: What is not covered

- Limits: The maximum amount the insurer will pay

- Deductibles: The amount the policyholder must pay before coverage applies

- Conditions: Rules that must be followed for coverage to remain valid

Many problems arise when people purchase insurance without understanding these elements. Reading and understanding a policy is one of the most important steps in using insurance effectively.

Why Insurance Exists in Modern Society

Insurance plays a vital role in modern economies. Without it, many everyday activities would be financially impossible or extremely risky.

For example:

- Mortgages depend on home insurance

- Driving relies on auto insurance

- Healthcare systems are built around health insurance

- Businesses require insurance to operate legally and responsibly

In this sense, insurance is not just a personal tool — it is a pillar of economic infrastructure.

Common Misconceptions About Insurance

There are several widespread misunderstandings about insurance that lead to poor decisions.

One common belief is that insurance is wasted money if no claim is made. In reality, insurance provides value through peace of mind and financial stability, not just payouts.

Another misconception is that the cheapest policy is the best option. Low premiums often come with higher deductibles, limited coverage, or restrictive exclusions.

Insurance should be evaluated based on protection, not price alone.

Insurance and Legal Responsibility

In many situations, insurance is required by law. This is especially true in the United States, where legal liability can result in significant financial exposure.

Auto insurance, for example, protects not only the policyholder but also others who may be affected by an accident. Liability insurance ensures that individuals and businesses can meet legal obligations if they cause harm.

From a legal standpoint, insurance helps maintain fairness and accountability within society.

The Human Side of Insurance

Beyond contracts and numbers, insurance exists to protect people. It helps families recover after unexpected losses and allows businesses to continue operating after disruptions.

In professional practice, it becomes clear that insurance decisions are often emotional as well as financial. People seek stability, predictability, and security — all of which insurance is designed to provide.

Understanding this human element is key to appreciating why insurance remains relevant despite its complexity.

The Role of Technology in Understanding Insurance

Technology has made insurance more accessible and transparent. Online platforms allow users to compare policies, understand coverage options, and manage claims more efficiently.

Digital tools also help simplify complex concepts, making it easier for people to understand what insurance actually does. This shift has improved awareness and reduced barriers to entry, especially for younger and tech-savvy users.

Why Learning What Insurance Is Matters

Understanding insurance leads to better decision-making. People who understand the basics are more likely to choose appropriate coverage, avoid costly mistakes, and view insurance as a long-term strategy rather than a short-term expense.

Whether for personal protection or business continuity, insurance knowledge provides a meaningful advantage.

Conclusion

Insurance is a structured way to manage uncertainty. It protects individuals, families, and organizations from financial hardship by spreading risk across a larger group.

By understanding what insurance is, how it works, and why it exists, people can make smarter choices and use insurance as it was intended — as a tool for resilience and stability in an unpredictable world.