In today’s digital world, buying insurance can seem straightforward. Many companies offer instant online quotes, policy comparisons, and digital policy management tools. Because of this accessibility, some people question whether working with an insurance broker is still necessary.

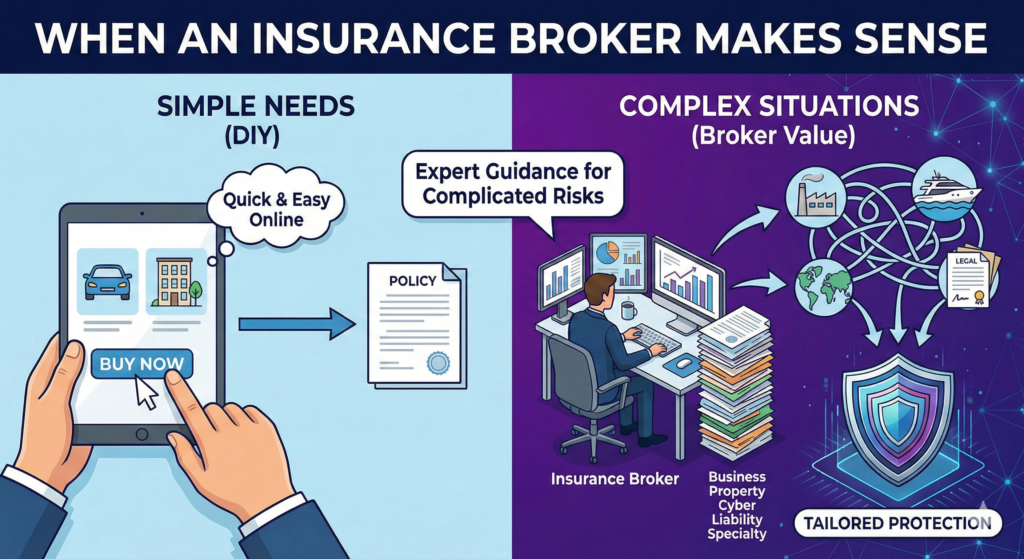

The answer depends on the complexity of your situation.

For simple insurance needs, such as basic auto or renters insurance, purchasing directly from a carrier may be sufficient. However, in more complex situations — especially those involving multiple policies, business exposure, or specialized risks — an insurance broker can provide meaningful value.

Understanding when an insurance broker actually makes sense requires examining the role brokers play and the types of situations where their expertise becomes important.

What an Insurance Broker Does

An insurance broker acts as an intermediary between clients and insurance companies.

Unlike agents who may represent a single insurer, brokers typically work with multiple carriers. Their role is to:

- Assess a client’s risk exposure

- Identify coverage needs

- Compare policies across insurers

- Explain policy terms

- Assist with claims navigation

Brokers are compensated through commissions paid by insurers, though compensation structures may vary.

The key distinction is that brokers generally offer access to multiple insurance providers rather than a single company’s products.

When Insurance Needs Are Simple

In straightforward situations, a broker may not always be necessary.

Examples include:

- Minimum required auto insurance

- Basic renters insurance

- Standard homeowner coverage in low-risk areas

In these cases, online comparison tools and direct purchase platforms can provide adequate information for decision-making.

If risk exposure is limited and coverage needs are standard, the added value of a broker may be minimal.

When Coverage Needs Become Complex

An insurance broker often makes sense when coverage needs extend beyond basic policies.

Complex situations may include:

- Owning multiple properties

- Running a business

- Operating in a regulated industry

- Managing significant assets

- Handling international exposure

In these scenarios, insurance requirements may involve layered coverage, endorsements, and coordination between multiple policies.

A broker can help structure these components coherently.

When You Own or Operate a Business

Business insurance is one of the most common areas where brokers provide substantial value.

Businesses often require combinations of:

- General liability insurance

- Professional liability insurance

- Cyber insurance

- Workers’ compensation

- Commercial property coverage

Determining appropriate coverage limits, endorsements, and exclusions requires a detailed understanding of risk.

For entrepreneurs, startups, and growing companies, brokers can help align coverage with operational realities.

When You Need Specialty or Niche Coverage

Specialty insurance products often require tailored underwriting.

Examples include:

- Directors and officers (D&O) insurance

- Product liability insurance

- Event insurance

- High-value property coverage

- Industry-specific professional liability

Because specialty coverage varies widely between insurers, brokers can help compare nuanced differences.

They may also assist in negotiating customized terms.

When You Want Objective Policy Comparison

Insurance contracts can be complex.

Two policies with similar premiums may differ significantly in:

- Coverage limits

- Deductible structures

- Exclusions

- Claims handling processes

A broker can help interpret these differences and explain practical implications.

This is particularly helpful when evaluating liability exposure or high-value assets.

When You Have Significant Liability Exposure

Individuals with substantial personal assets may face higher liability risk.

In these cases, coordinating:

- Homeowners insurance

- Auto insurance

- Umbrella liability insurance

becomes important.

A broker can assess whether standard limits are adequate or whether additional protection is appropriate.

Liability coordination across policies often requires professional insight.

When You Lack Time to Compare Options

Insurance comparison requires reviewing policy documents, endorsements, and coverage terms carefully.

For individuals or business owners with limited time, brokers can streamline this process.

Rather than contacting multiple insurers independently, clients can work through a single point of contact.

Efficiency can be a practical advantage.

When Claims Support Matters

During claims, especially complex ones, navigating documentation and communication can be challenging.

Some brokers assist clients in coordinating with insurers during the claims process.

While brokers do not control claim decisions, they may provide guidance and clarification.

For businesses facing significant claims, this support can be valuable.

When Regulatory or Contractual Requirements Apply

Businesses often face contractual obligations requiring specific insurance limits.

For example:

- Commercial leases

- Vendor agreements

- Client contracts

- Government procurement requirements

Understanding and meeting these obligations requires careful review.

Brokers familiar with regulatory and contractual language can help ensure compliance.

Situations Where a Broker May Not Be Necessary

There are circumstances where a broker may not add substantial value:

- Simple personal policies with standard coverage

- Situations where a client prefers direct digital management

- When a consumer is comfortable reviewing policy documents independently

Technology has made direct insurance purchasing more accessible.

However, accessibility does not eliminate complexity in certain scenarios.

The Importance of Transparency

When working with a broker, it is important to:

- Understand how compensation works

- Clarify whether the broker represents multiple insurers

- Ask about conflicts of interest

- Request clear explanations of recommendations

Transparency supports informed decision-making.

A reputable broker should provide clear, documented information.

Technology and the Evolving Role of Brokers

Digital platforms have transformed insurance distribution.

Many brokers now use:

- Online comparison tools

- Digital quoting systems

- Electronic document management

- Data analytics for risk assessment

Technology has increased efficiency but has not eliminated the need for human expertise in complex cases.

Brokers increasingly combine digital tools with advisory services.

Cost Considerations

Working with a broker does not typically involve direct fees for standard policies, as commissions are paid by insurers.

However, in certain specialized or commercial contexts, fee-based advisory structures may apply.

Clients should clarify compensation structures in advance.

The decision to work with a broker should focus on value relative to complexity, not simply perceived cost.

Broker vs. Independent Research

The choice between working with a broker and conducting independent research depends on:

- Risk complexity

- Time availability

- Financial exposure

- Comfort level with policy analysis

Some individuals prefer direct control over policy selection. Others value expert guidance.

There is no universal answer — only context-specific decisions.

Conclusion

An insurance broker makes sense when insurance needs become complex, layered, or highly specialized. While simple personal policies may not require professional assistance, business operations, high-value assets, liability coordination, and regulatory obligations often benefit from broker expertise.

Insurance is not merely about purchasing a policy — it is about structuring protection strategically. In situations where risk exposure extends beyond basic coverage, a broker can help clarify options and align insurance with financial and operational realities.

Choosing whether to work with a broker should be based on complexity, not assumption.